$40 bn needed to lift Africa’s refining capacity - OPEC

Part of the 650,000 bpd Dangote Refinery in Nigeria.

Africa is poised for substantial growth in its refining capacity, set to add 1.2 million barrels per day (bpd) by 2030, which OPEC identifies as one of the fastest downstream expansions globally.

According to the 2025 OPEC World Oil Outlook, this growth is being spearheaded by large-scale projects, with Nigeria's 650,000 bpd Dangote Refinery at the forefront. Other key projects are in Angola (Lobito and Soyo Refineries) and Uganda (Hoima facility), as well as modular refineries in other countries like Ghana, Guinea-Conakry, and the DR Congo. potentially reshaping the continent’s energy independence and investment appeal.

Since starting operations in 2024, the Dangote Refinery has begun to shift regional fuel trade dynamics. Nigeria is also home to the 200,000-bpd Akwa Ibom Refinery.

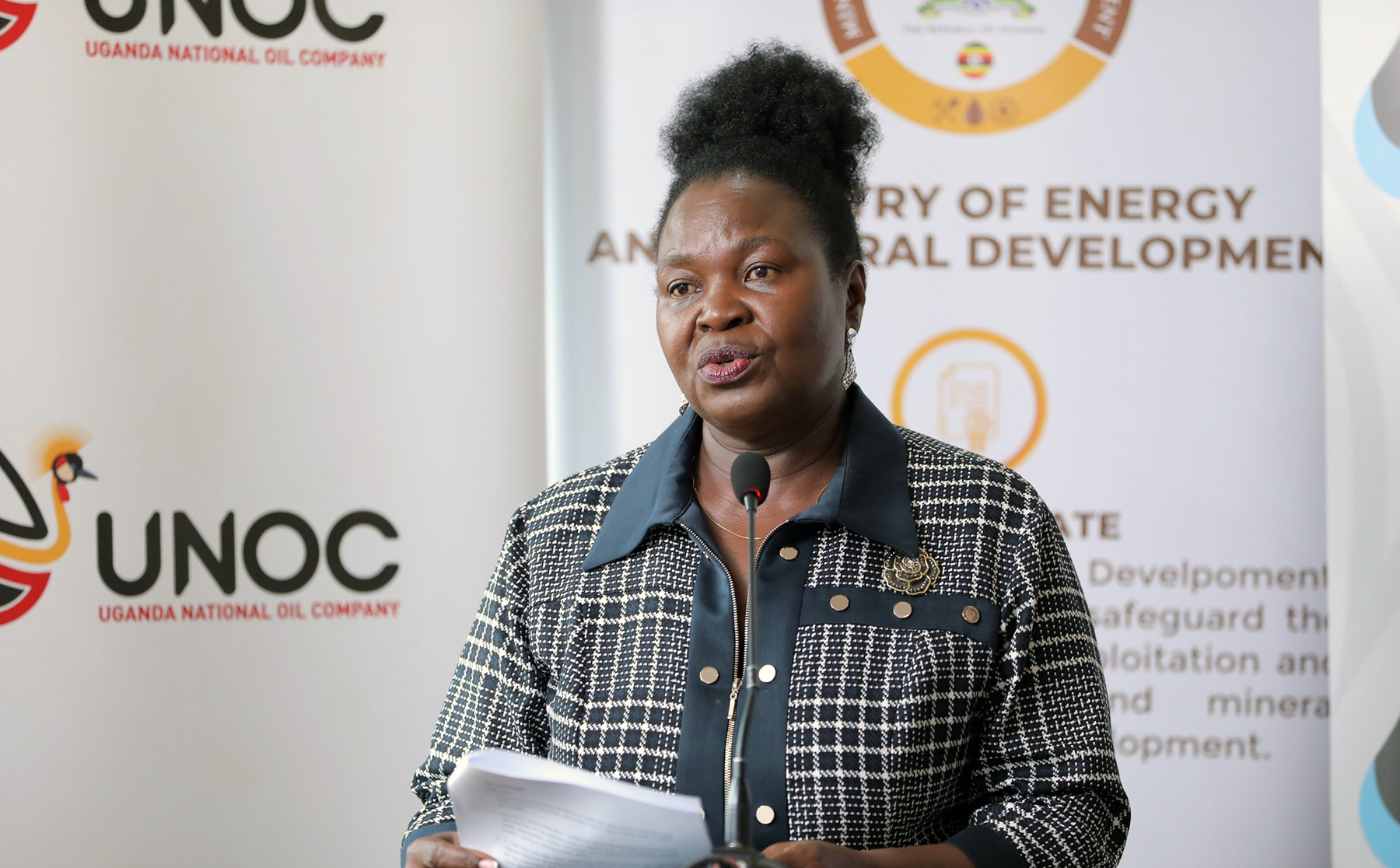

- Set to become a petroleum products producer in her own right, Uganda is advancing with a 60,000-bpd facility in Hoima, as part of the Lake Albert basin development.

OPEC projects that Africa's domestic crude consumption will nearly triple, rising from 1.8 million bpd in 2024 to 4.5 million bpd by 2050. This is the primary driver for the increased refining capacity and reflects a push to meet internal energy demand.

Meanwhile, modular refineries in Ghana, Guinea-Conakry, the Republic of Congo, and additional sites in Nigeria are addressing infrastructure and financing challenges with scalable solutions. In North Africa, Algeria, Libya, and Egypt are advancing projects to improve margins, enhance domestic supply security, and reduce reliance on refined imports.

- To meet its objectives, the report says Africa will need over $40 billion in refining investments by 2030, with an additional $60+ billion required for new construction, modernization, and upgrades beyond that date. This totals a projected investment need of $100 billion through 2050.

With most global refinery additions happening in Asia-Pacific, Africa, and the Middle East, Africa is emerging as a high-growth area, the report adds.

According to the Outlook, this refining expansion represents a turning point for Africa, allowing the continent to move beyond being a raw crude exporter and become a more competitive, resilient, and integrated energy producer.

The 2025 African Energy Week (AEW) in Cape Town will be a crucial event for aligning refinery projects, policy incentives, and investment opportunities.

As domestic crude consumption is expected to rise to 4.5 million bpd by 2050 from 1.8 million bpd in 2024, Africa’s crude exports will likely decrease by over one million bpd by 2050, underscoring a shift towards internal value chains.

- Africa’s refining expansion represents both a technical and strategic turning point. By capitalising on this momentum, the continent can transition from a raw crude exporter to a competitive, integrated energy producer.

- With $100 billion in projected investment needs through 2050, now is the time to focus on Africa’s downstream sector.