Zero dividends as Vision Group losses worsen

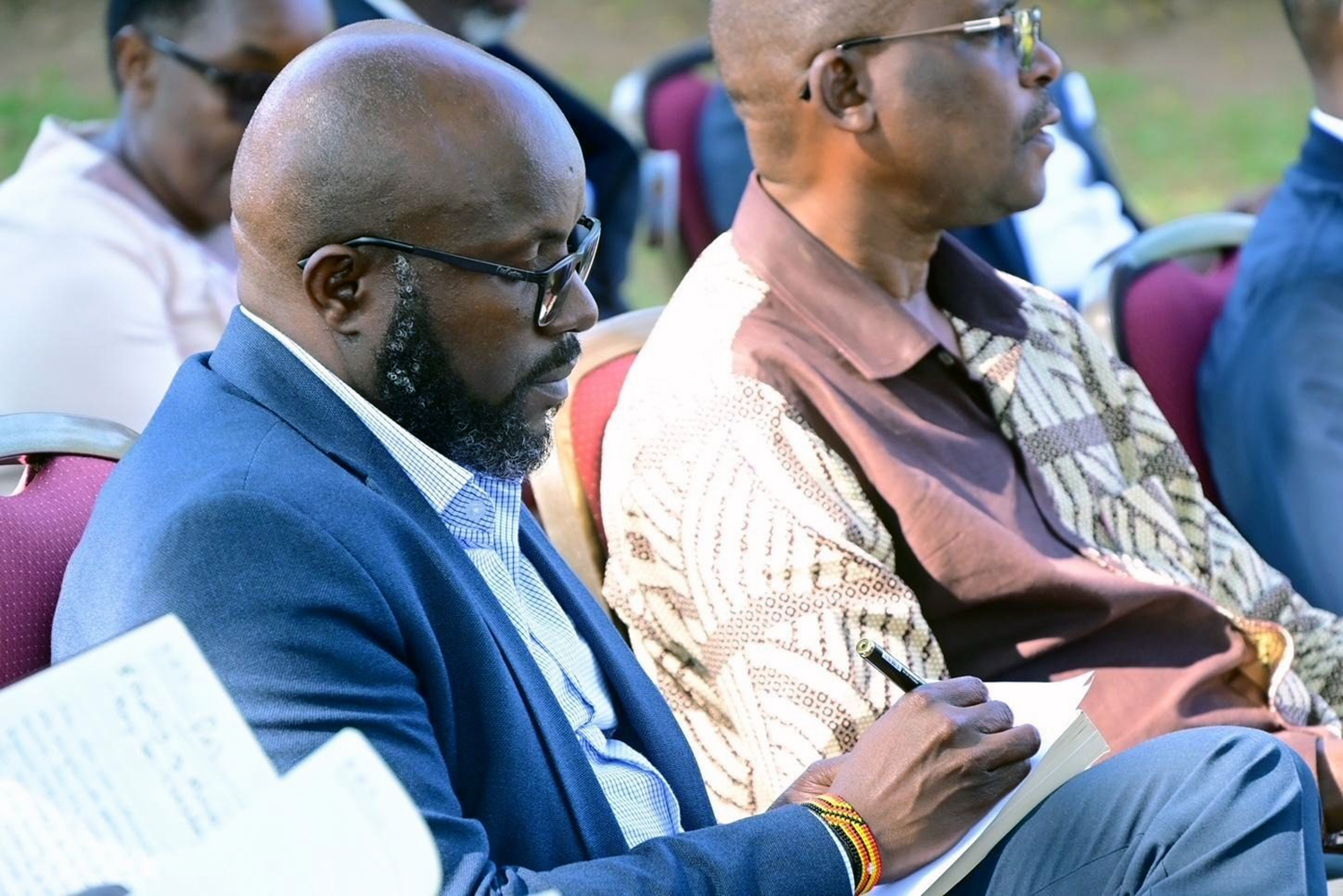

Vision Group bosses, CEO Don Wanyama (L), flanked by his deputy, Gervase Ndyanabo (R) and Editor -in-chief Barbra Kaija (behind), have a lot of thinking to do to revive the company's fortunes. FILE PHOTO

Uganda’s largest media house, New Vision Printing and Publishing Corporation, has reported a further decline in its financial performance for the year ending June 2024, extending its loss-making streak for the fourth consecutive year.

The company, which is 53.3% owned by the government, recorded a loss of more than UGX11 billion, more than double the UGX5.46 billion loss it posted in June 2023, as it grapples with a challenging business environment and declining revenues across several key sectors.

The second biggest shareholder is the National Social Security Fund (NSSF) with 19.6%.

- In the period under review, the company’s turnover dropped by 8.3%, from UGX87.6 billion to UGX80.3 billion, with almost all of its business segments facing downturns, except commercial printing.

Results published on November 20 show that commercial printing saw an improvement in revenue, increasing from UGX16.2 billion to UGX 19.8 billion. The newly established outdoor advertising segment also made a modest contribution of UGX 811 million.

However, revenues from the traditional media sectors, including print and electronic media, were the most-hit. Print media, which accounted for 39% of the company’s revenue, experienced a decline of approximately UGX3 billion, falling to UGX 31.6 billion.

- Electronic media also saw a drop of UGX2.6 billion, falling to UGX 24.2 billion. Publishing, a key area, also suffered a sharp decline, bringing in only UGX1.6 billion compared to UGX7.3 billion the previous year.

The company attributed its performance to several factors, including the rise in cost of raw material inputs like newsprint and commercial paper, which it says rose by 2.8% further pushing up the cost of sales and contributing to the overall loss.

The financial report shows that the company has invested UGX4 billion in the outdoor advertising segment, installing digital screens in key areas of Kampala. The initiative has generated some positive traction, including securing new clients and generating UGX811 million in revenue. However, these measures have not been enough to offset the wider downturn in the business.

The company also saw a slight reduction in its operating costs, with administrative expenses decreasing slightly by 1.6%. However, gross profit recorded a 55% decline to UGX7.7 billion from UGX17 billion recorded the previous year. However, the listed company’s overall financial outlook remains bleak.

As a result of the ongoing losses, the board has announced that no dividends are to be paid to shareholders this year, citing the company’s loss position. The loss per shareholder has more than doubled, with each shareholder losing UGX146.4, compared to UGX71.4 last year.

- Revenue from publishing, advertising, circulation, and commercial printing all dropped, reflecting the broader challenges the company is facing going forward.

- The ongoing challenges in the traditional media sector, coupled with rising input costs and a volatile business environment, are expected to affect performance throughout the year.

Despite these challenges, the company said it remains committed to navigating these tough times through diversification into new markets and cost-optimization measures. However, it remains to be seen if these efforts would be sufficient to reverse the company’s fortunes in the coming years.

With revenues continuing to fall, especially in traditional media, and operational costs rising, Vision Group faces an uphill battle to restore profitability.

The company’s losses reflect broader trends in the media industry, where traditional advertising models are being disrupted by the new media technologies, and businesses are grappling with increased costs and rapidly changing consumer behavior.

.jpg)