Minority owners overwhelmingly endorse MTN MoMo separation

MTN Uganda and MTN Mobile Money (U) Limited chiefs address minority shareholders at the company's headquarters in Kampala yesterday.

MTN Uganda Limited shareholders have overwhelmingly approved the proposed structural separation of its mobile money and fintech business, MTN Mobile Money (U) Limited (“MTN MoMo”), marking a significant milestone in the company’s strategic evolution into a fintech giant with global partners.

The resolution was passed during a hybrid Extraordinary General Meeting (EGM) held yesterday, where shareholders voted with 99.9% in support of the transaction, a move that will see the amalgamation of MTN MoMo into a new entity, which, pending regulatory approvals, will operate under a new company majority-owned by MTN Group Fintech Holdings B.V.

The company said in a press release that the remaining shares would be held through a trust structure, ensuring continued benefit for MTN Uganda’s institutional and retail minority shareholders.

- Charles Mbire, the Chairman of the Board of MTN Uganda, commended shareholders for their unwavering support. “We are grateful to our shareholders for their confidence and backing of this strategic step. This transaction aligns with global market trends and is designed to unlock value for our shareholders while future-proofing the fintech business. The Board is confident that this decision is in the long-term interest of all stakeholders.”

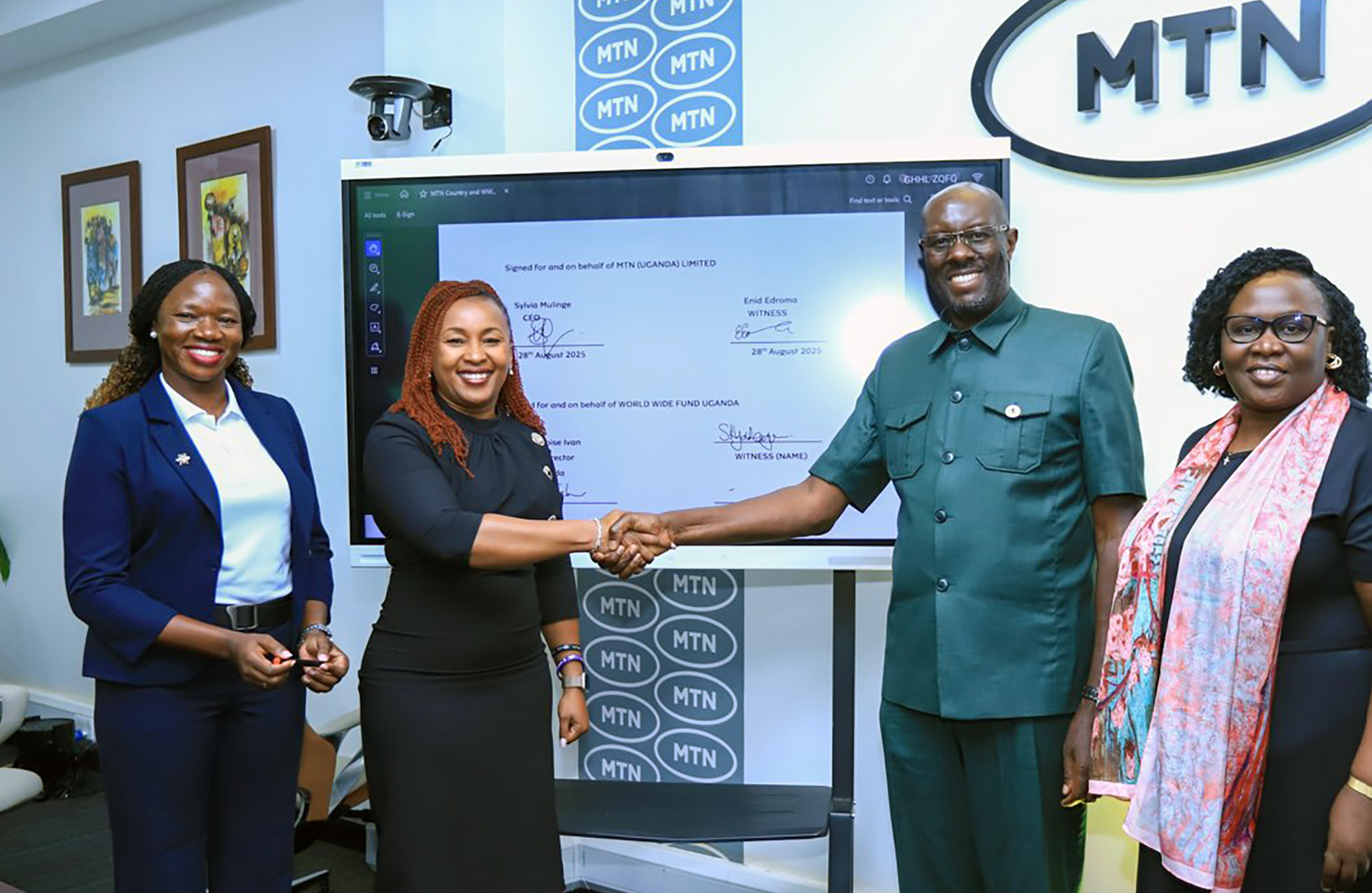

Sylvia Mulinge, Chief Executive Officer of MTN Uganda, reiterated the company’s commitment to delivering meaningful impact through digital and financial inclusion.

“Today’s shareholder approval marks a significant milestone in our journey to accelerate financial and digital inclusion in Uganda. The structural separation of our fintech operations enables us to drive sharper operational focus, enhance agility, and unlock greater efficiency to deliver superior shareholder value and transform lives through digital innovation.”

- Richard Yego, the Chief Executive Officer of MTN MoMo Uganda Ltd expressed his optimism for MoMo’s growth following the separation, saying the structural separation is part of the journey of building the largest Fintech platform in Africa.

Sylvia Mulinge, the MTN Uganda CEO, speaks at the general meeting.

Sylvia Mulinge, the MTN Uganda CEO, speaks at the general meeting. MTN Uganda Ltd, which was listed on the Uganda Securities Exchange (USE) in December 2021, is partly owned by minority shareholders who own 23.985% shares. MTN Mobile Money, which has become a cash-cow for the shareholders, has seen total revenue grow by 22.8% to UGX947.5 billion.

The separation involves the transfer of the mobile money business to a new company to be jointly owned by MTN Group Fintech Holdings B.V. and a ‘trust’ representing the minority institutional and retail shareholders.

Crucially, the structural separation was necessary as a move to attract strategic fintech partners and financiers who are expected to bring onboard capital, technologies and critical sector capabilities.

For example, the MTN Group and the global payments giant Mastercard in 2023 signed an MoU for a minority investment into MTN Group Fintech across the 13 African countries where MTN operates. The multi-market partnership would involve Mastercard investing $200 million for a 3.8% stake in the company.

- The partnership has so far introduced virtual and physical Mastercard companion cards to every MoMo wallet, granting users access to over 100 million acceptance locations globally. Founded in 1966, Mastercard is an American multinational payment services corporation that operates a global payment processing network connecting billions of consumers, financial institutions, and merchants worldwide.

- In 2024, Mastercard’s total revenue amounted to $28.17 billion, registering 12.23% growth compared to 2023. The company recorded more than 4 billion transactions per month in 2024, demonstrating the significant role it’s playing in promoting digital payment adoption, supporting financial inclusion for marginalized groups, simplifying intricate cross-border transactions, and consistently developing new technologies to improve user experience and security.

Mastercard has built a vast global network, connecting consumers, merchants, and banks across over 210 countries and territories. This widespread acceptance has been instrumental in shifting transactions from cash to electronic payments, amplified by events like the COVID-19 pandemic.

With global partners such as Mastercard, the MTN Group hopes to make a significant contribution to the enablement of financial inclusion, aiming to accelerate cross-border payments and to connect underserved populations to the digital economy, including individuals, small enterprises, SMEs and SACCOs across Uganda.

Sources told this publication that MTN plans to also list MTN Mobile Money (U) Limited on the Uganda Securities Exchange within three years.