Dubai billionaire takes over Uganda Telecom Ltd

Dr al Taki (R), the RCC boss, and Baryomunsi sign the deal at State House. PPU PHOTO/BUSINESS EDGE

A multi-billion-dollar investor based in Dubai in the United Arab Emirates (UAE), has acquired a majority stake in the Uganda Telecommunications Corporation Limited (Utel) following the signing of an agreement with the Government of Uganda.

According to a press release, Dr. Chaher Al Taki, the proprietor of Rowad Capital Commercial (RCC), signed the deal with Uganda’s Minister of ICT and National Guidance, Dr. Chris Baryomunsi, at an event that was witnessed by President Yoweri Museveni at State House, Entebbe.

In his remarks, President Museveni stated that the milestone was important because the government is keen on creating jobs for Ugandans. “Our main interest is to get investors to create wealth and jobs,” he said.

- Al Taki said he was extremely delighted to finally see the project come to fruition and pledged to open up other new projects in Uganda.

“I am very happy to be here at the State House to meet His Excellency President Museveni and the government officials who have come to bless the signing of the agreement. Uganda is our second home, and we can invest in more projects here as we had promised,” he said.

Reports of RCC’s interest in Utel first emerged in August when press reports suggested that Rowad Capital Commercial was keen to invest an initial $225 million in it’s the telecommunications operator in exchange for a 60% stake.

- Founded in 2017, RCC comes on board to faceoff with stiff competition in a telecommunications market dominated by South Africa’s Mobile Telecommunications Network (MTN) and Airtel Uganda, a subsidiary of Bharti Airtel Limited, a global telecommunications company based in India.

Following the splitting of Uganda Posts and Telecommunications Corporation in 1998, UTL was partially privatized in 2000, with a consortium led by Telecel International and the Dhirani Group acquiring a 51% stake. The government retained a 49% share. This marked the start of UTL as a private-public partnership and led to significant modernization of the telecom infrastructure.

In the early 2000s, UTL rapidly expanded its operations, providing both fixed-line and mobile telephony services. During this period, it introduced internet services and mobile solutions such as Mango, a mobile service provider.

However, competition in the Ugandan telecom market intensified as other telecom companies like MTN Uganda and Airtel Uganda gained a foothold, challenging UTL's dominance.

By the mid-2010s, UTL began experiencing severe financial difficulties. Competition, mismanagement, and growing debt resulted in significant challenges for the company.

- The Libyan investment fund Libyan Post, Telecommunication, and IT Company (LPTIC), which had acquired a major stake in UTL after Telecel International's exit, faced sanctions following the fall of Muammar Gaddafi's government, further complicating UTL's financial situation.

- In 2017, UTL was placed under provisional administration due to its heavy debts, and the Ugandan government took control of the company. At the time, the company’s debts were estimated to be around UGX700 billion (approximately $190 million). The government subsequently expressed its intent to find new investors to restore the company’s operational capacity.

Analysts say Utel remains an important part of Uganda’s telecom landscape, particularly if Government Ministries, Departments and Agencies (MDAs) are directed to acquire their mobile, fixed-line, and internet services from it.

In 2018, the government sought to have Utel take over certain NITA-U responsibilities, such as providing internet services to MDAs. This decision came under a presidential directive, emphasizing that all government ministries, departments, and agencies (MDAs) should switch to UTL for internet services.

NITA-U, which Parliament recently blocked from being rationalized (scrapped), has resisted this shift, citing concerns over service duplication and billions worth of outstanding payments owed by MDAs to Utel.

Similar Posts You May Like

-

DIAMOND TRUST BANK (DTB) JOIN HANDS WITH MATERCARD TO DEEPEN FINANCIAL INCLU..

Diamond Trust Bank – DTB AND Mastercard have embarked on a drive to increase financial inclusion in the eleven Districts of the West Nile region. These districts include; Arua, Koboko, Yumbe, Zombo, Maracha, Nebbi, and Adjumani among others. The drive intends to increase the usage of formal bankin..

-

MTN Uganda unveils ICT lab at Kabale Preparatory School in Kabale District..

Thursday 23 March 2023 - Kabale, Uganda: Kabale Preparatory School in Kabale District has benefited from a fully equipped computer lab as part of the MTN Uganda Foundation's efforts to boost information and communication technologies in schools and communities. The facility comes with 10 compu..

-

UKETA Launches Online Courses to Upskill Professionals and Empower Organizat..

In the latest demonstration of the potential and growth of online education, Simba Group has launched UKETA, an innovative online course platform designed for professionals. The platform is designed to provide a comprehensive and flexible learning experience, empowering professionals to acquire new..

-

Inside MTN Uganda's transition to a tech firm..

MTN Uganda, like most telecom companies around the world, has recorded rapid transformation in its operations, customer experience and development of various products and services aimed at responding to evolving consumer needs...

-

MTN Uganda Named Best in Africa..

MTN Uganda has won a UGX380 million cash prize after being named the overall winner of the Group’s Yellow Care Campaign for 2023. ..

-

MTN machines boost Sironko women..

About nine years ago, Sandra Nakayenze launched Kalaa Mugoosi Women Empowerment, a social enterprise whose main objective was to empower the rural women of Sironko District in eastern Uganda, to add value to their coffee...

-

MTN Boosts Kajjansi skilling centre with UGX17m..

Five years ago, Ms Mariam Nakirijja, a community health worker, visited the Nottingham Trent University, one of the best multi-skilling institutions in England. ..

-

Monzer named new MTN South Sudan boss..

The MTN Group has appointed Ali Monzer as Chief Executive Officer of MTN South Sudan, the country�s largest telecommunications company, effective April, 2024. ..

-

MTN�s voice revenue rebounds amid data surge..

MTN Uganda has posted impressive growth in voice revenue despite a surge in data demand among consumers. The telecom giant revealed that voice revenue experienced double-digit growth of 10%, fueled by increased adoption of attractive bundle offerings and aggressive subscriber growth initiatives, amo..

-

MTN scoops fastest internet award..

Ookla, the global leader in internet testing and analysis, has announced MTN Uganda as the Fastest Mobile Network...

-

MTN injects UGX20m into Jinja skills institute..

In an ambitious effort to boost vocational training standards in Busoga and beyond, the MTN Foundation, MTN Uganda's philanthropic arm has donated state-of-the-art equipment to Heta Vocational Ground in Jinja City...

-

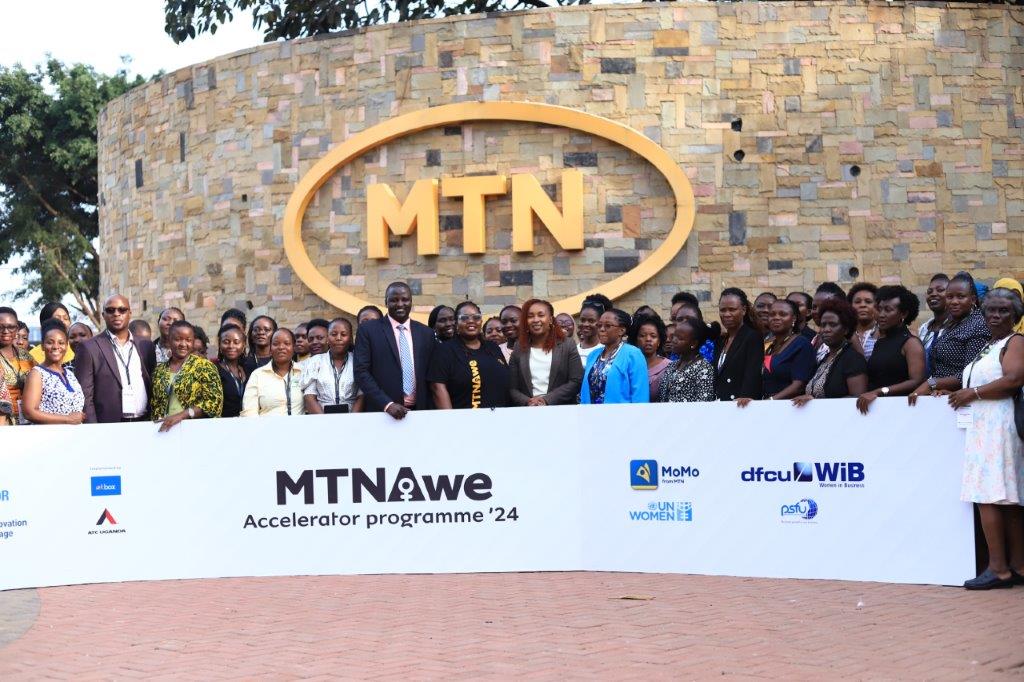

118 women chosen to be MTN service providers..

MTN Uganda has unveiled more than 100 women entrepreneurs who are to provide goods and services to the telecommunications giant, as a new initiative aimed at empowering and uplifting women-led businesses in the country...

-

Vendors get UGX10m for using mobile money..

As part of its efforts to champion financial inclusion and empower women, MTN Mobile Money, in partnership with Ericsson, has rewarded women vendors at Kalerwe Market in Kampala, for encouraging their customers to use mobile money for their grocery purchases...

-

Airtel Uganda boosts UCC fund with UGX34.8 billion..

Airtel Uganda has handed over a cheque worth UGX34.8 billion to the Uganda Communications Commission aimed at supporting the establishment of better communication infrastructure and technologies in rural areas across the country...

-

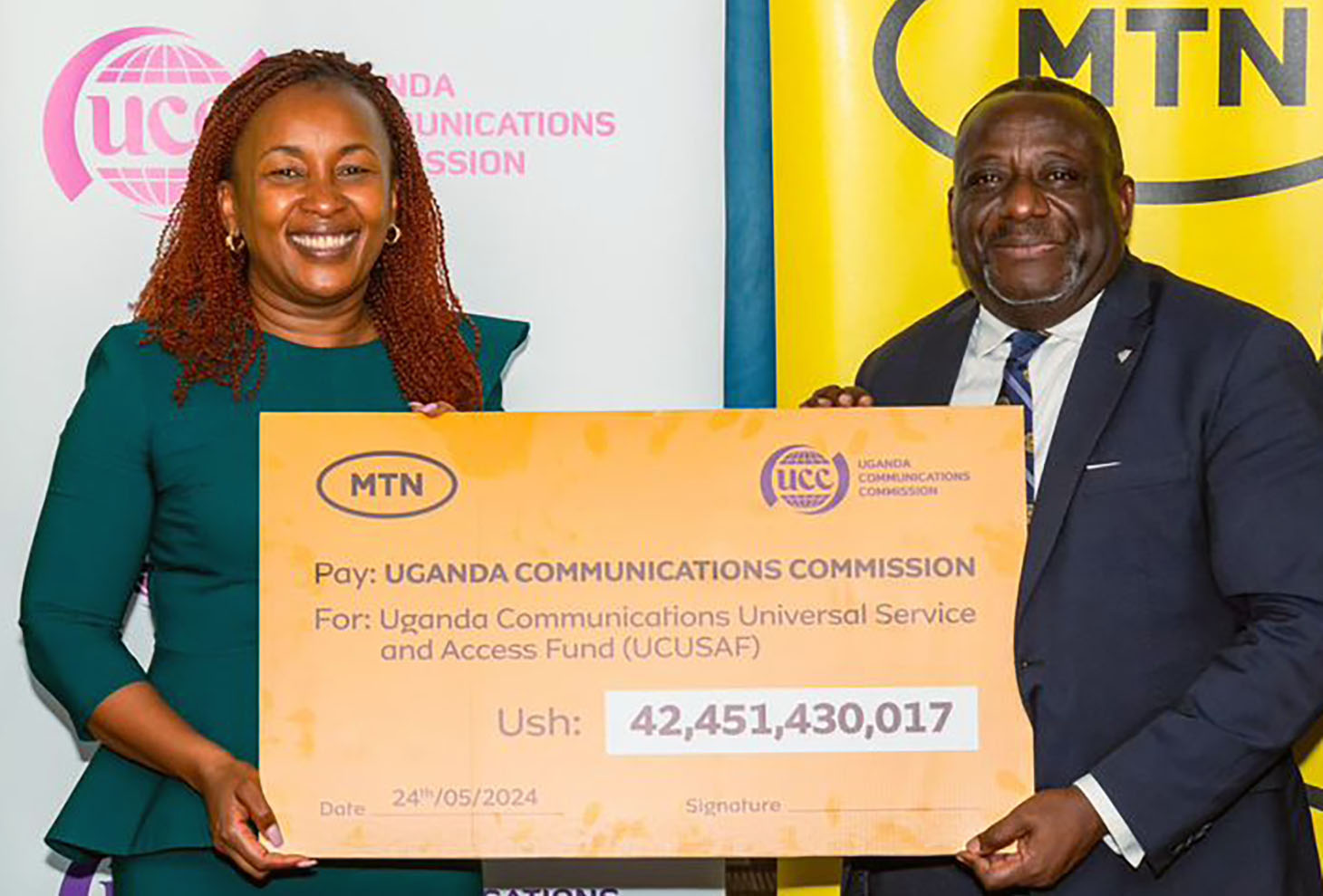

MTN contributes UGX42.5 billion to UCC Fund ..

MTN Uganda has handed over a contribution of UGX42.5 billion in a major boost to the Uganda Communications Commission’s Universal Service and Access Fund. The amount indicates a significant increase from last year's UGX36 billion...

-

Uganda Cranes fans to receive millions from MTN..

In a bid to re-ignite passion for the national football team, the Uganda Cranes, MTN Uganda has launched a new campaign to identify and reward the country’s top cheerleaders ahead of the forth-coming World Cup 2026 qualifiers. ..

-

MTN offers 1.5 billion additional shares to Ugandans..

MTN Uganda has received the green light from the capital markets regulators to sell more than 1.5 billion ordinary shares to the public...

-

MTN offers girls’ skilling initiative UGX270 million boost ..

Smart Girls Foundation, a Kasangati-based girls’ skilling initiative, is set to receive an additional UGX271 million from MTN Uganda as part of the MTN Girls in Tech program, which aims at equipping more than 500 girls with digital skills...

-

MTN restores five forests, set to introduce electric vehicles..

In an ambitious move aimed at pioneering environmental stewardship for a sustainable future, MTN Uganda has registered tremendous success in restoring forest reserves, slashing carbon emissions and is now set to produce wind power and replace part of its fleet with electric vehicles...

-

MTN launches UGX4.5 bn project for youth..

In January last year, Brian Tweheyo conceived the idea of a digital solution that would make renting easier for both tenants and landlords in the residential and commercial rental space...

-

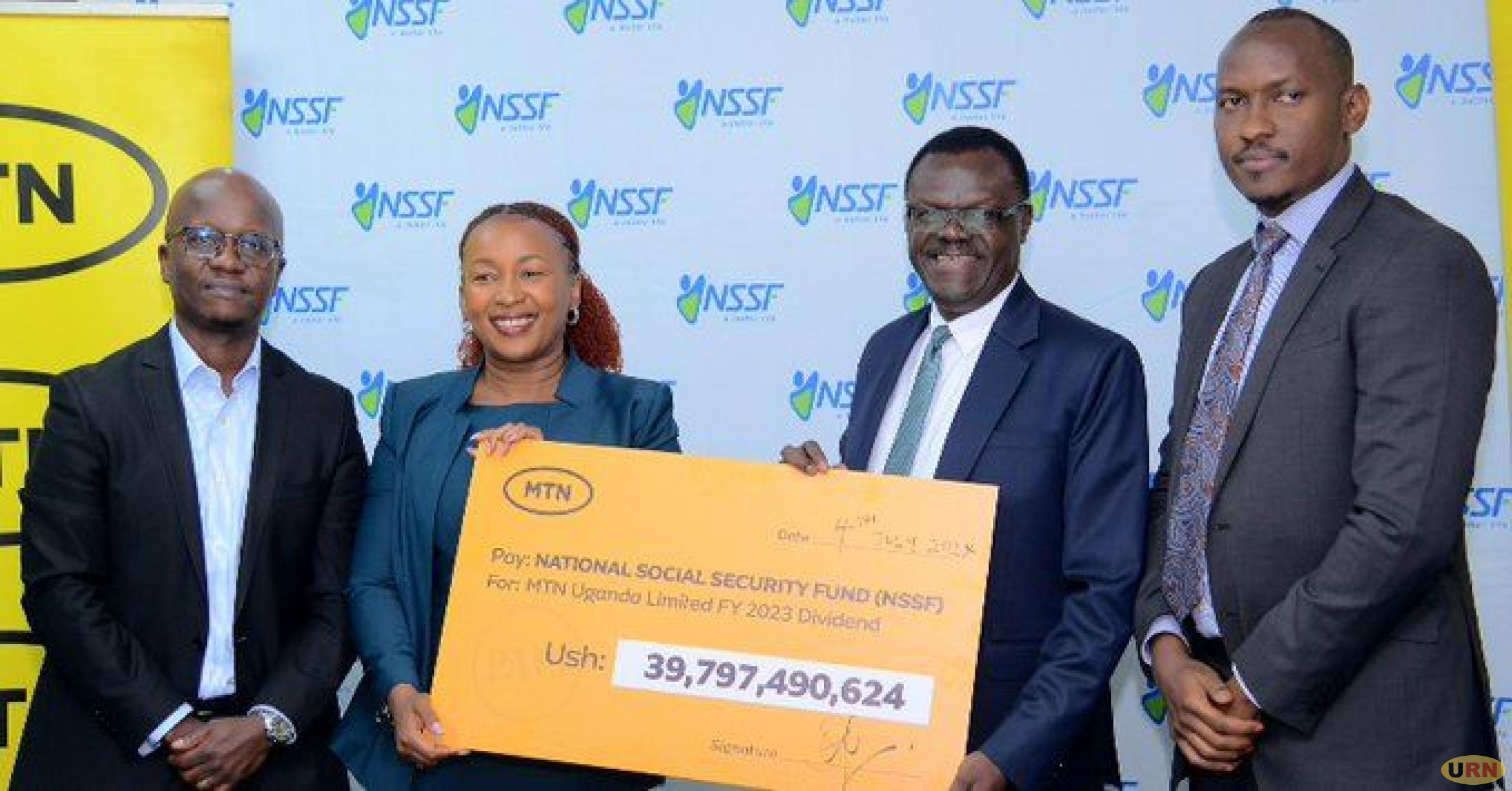

MTN pays UGX40bn NSSF dividends as Fund surpasses targets ..

The National Social Security (NSSF) says it ended the financial year 2023/2024 on a good note having surpassed the targets. ..

-

Huawei to set up Digital Village Prototype in Butaleja..

President Yoweri Kaguta Museveni has held a meeting with a delegation from Huawei Technologies, at which the company announced plans to establish the country’s first Digital Village Prototype...

-

‘Uncle Money’ wins MTN’s cheer-leader money..

Team Uncle Money has been declared winners of MTN’s official Uganda Cranes Cheerleaders competition dubbed ‘Tulage faaya.’..

-

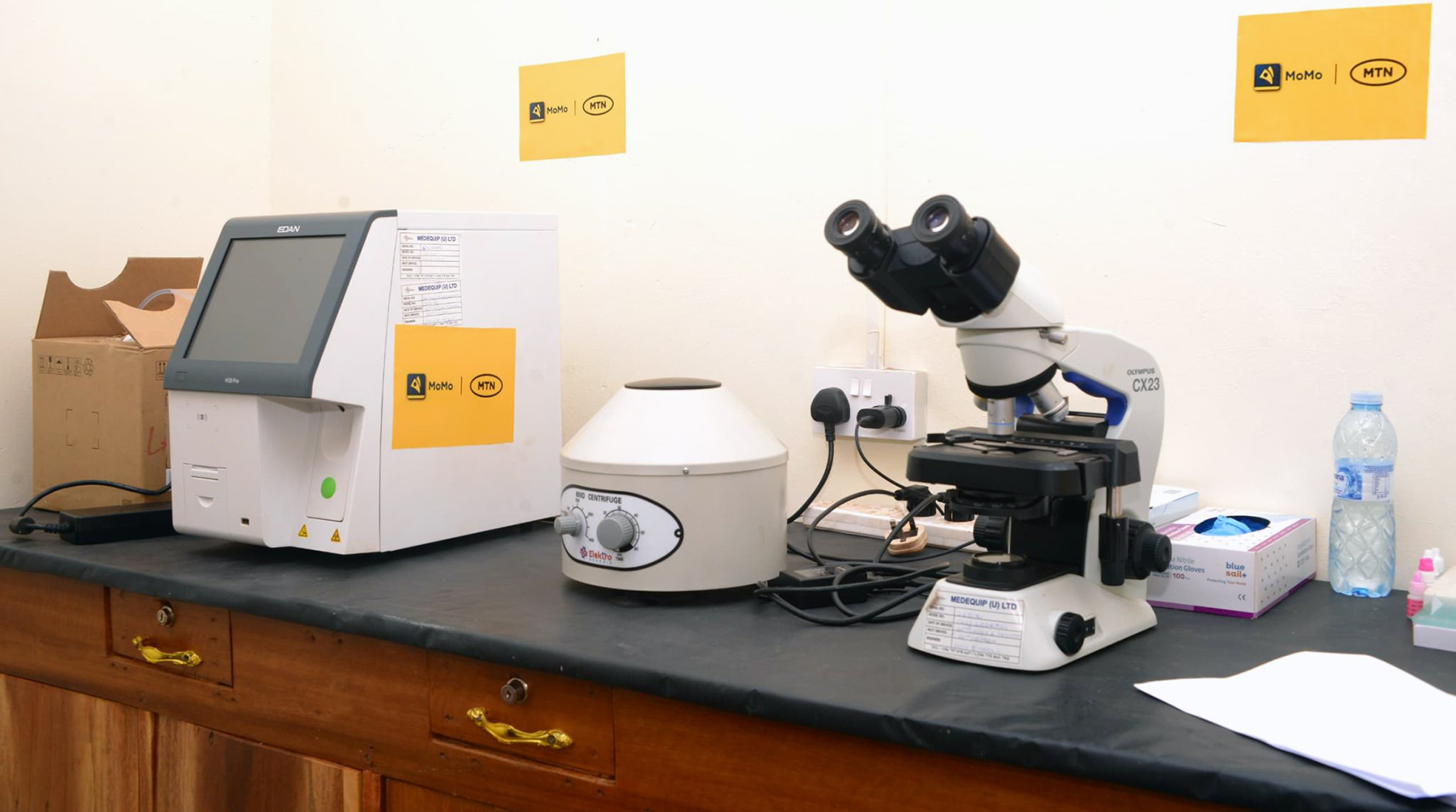

MTN gives Nawansega hospital UGX58m injection..

MTN Uganda, through its philanthropic arm, MTN Foundation, has reaffirmed its commitment to improving healthcare access in Uganda with a significant donation valued at more than UGX58 million to Nawansega Health Centre III in Luuka District, in Eastern Uganda...

-

MTN half-year net profits soar to UGX295 billion..

MTN Uganda has announced a net profit of UGX295.7 billion for the half-year ended June 2024, driven by robust growth in voice, data, and fintech services...

-

UGX500m MTN Changemakers 2nd phase launched ..

MTN Uganda, through the MTN Foundation, has announced the launch of the second phase of the MTN Changemakers Initiative, a transformative program designed to drive positive social change across Uganda. ..

-

Digital skills for youth must be an urgent priority..

"I can’t believe this is happening! We have computers now!" exclaimed Aisha Nakalema, a student at Bishop Dunstan Nsubuga Memorial School on Bugala Island, as we handed over 20 computers with free internet access to the institution. This was part of our 21 Days of Y’ello Care campaign, an annual..

-

MTN hands over UGX100 million Kiteezi relief..

MTN Uganda and MTN MoMo Uganda Ltd, through the MTN Uganda Foundation, have made a donation of relief items valued at UGX100 million to support 200 families affected by the Kiteezi garbage landfill landslide in Kasangati Town Council, Wakiso District...

-

MTN donates new car to single mother of five ..

True to her surname, which means ‘God has heard my prayers,’ Night Ampurire has been described by everyone as an extremely lucky woman...

-

Kazo school gets UGX65m MTN computer lab..

MTN Uganda, through its corporate social responsibility arm, MTN Foundation, has today enhanced the digital learning environment at St. Catherine Girls Secondary School in Kazo District, with the donation of a fully furnished computer laboratory valued at UGX65 million...

-

MTN Uganda top boss transferred to Rwanda..

Somdev Sen, the MTN Uganda Chief Marketing Officer, has been transferred to MTN Rwanda where he will take on a new role as Chief Digital and Commercial Officer, effective October 14...

-

MTN earmarks UGX390 million for six schools ..

MTN Uganda, through its corporate social responsibility arm, MTN Foundation, has earmarked UGX390 million to establish fully furnished computer labs in six educational and training institutions across the country...

-

Only 13% of Ugandans use Internet for business..

Just one out of every 100 Internet users in Uganda are utilizing it for business or work, the 2024 National Population & Housing Census has shown. ..

-

MTN profits top UGX460 billion in 9 months..

MTN Uganda has announced a 29.6% year-on-year increase in profit after tax, totaling Shs 459.4 billion for the nine months ending September 30, 2024. ..

-

MTN Uganda staff release 'Sunny Days' song..

In a bid to use music as a catalyst for positive energy at the workplace, MTN Uganda has released “Sunny Days”, a lively tune created by MTN Uganda employees under the MTN Got Talent program...

-

Starlink internet launch pushed to 2025..

US telecommunications giant Starlink’s launch in Uganda has been postponed to 2025...

-

MTN earmarks UGX370 billion for network expansion..

Telecommunications giant MTN Uganda has earmarked $100m (about UGX370) for investment in the Ugandan market. Speaking to journalists at their offices in Kampala, Sylvia Mlinge, the MTN Uganda CEO, said the capital expenditure would fund their infrastructure expansion programme countrywide aimed at d..

-

Soroti blind kids get hi-tech MTN computer lab..

MTN Uganda, through its MTN Foundation, in partnership with Sense International Uganda, has handed over a fully equipped computer laboratory to St. Francis Primary School for the Blind in Soroti, in a generous move aimed at enhancing digital inclusion for learners with disabilities...

-

Digital literacy plan in schools gets MTN boost ..

MTN Uganda, through its philanthropic arm, MTN Foundation, is stepping up its digital literacy efforts, reinforcing its role in bridging the country’s digital divide. ..

-

Mbarara school gets UGX70m MTN computer grant..

MTN Uganda, through its MTN Foundation, has donated a fully equipped computer laboratory to Revival Girls High School in Mbarara City, as part of its digital transformation agenda. ..

-

MTN nets UGX641.5bn profit in ‘landmark year’..

In what CEO Sylvia Mlinge describes as a “landmark year for MTN Uganda,” the telecommunications giant recorded significant gains across all areas of its business amidst a dynamic operating environment. ..

-

Youth NGO gets UGX20m ICT grant from MTN ..

In a bold step towards bridging the digital divide, MTN Uganda has provided ICT equipment worth UGX 20 million to the 40 Days Over 40 Smiles Foundation., a youth development focused local NGO...

-

Over 280 graduate after digital, technical training..

When Janat Nalwoga completed her Senior Four exams in 2022, she faced an uncertain future. With her father unable to work due to deteriorating eyesight, continuing her education seemed like an impossible dream. ..

-

MTN boosts kids with disabilities skills training ..

MTN Uganda, through its corporate social responsibility arm, MTN Foundation, has donated vocational training equipment to Teens and Tots Neuro Development Centre in Kira Municipality, Kampala...

-

MTN boosts Soroti school with UGX320m donation..

MTN Uganda, through its Corporate Social Responsibility arm, MTN Foundation, has inaugurated new facilities including a classroom block at Ocokican Community Secondary School in Ocokican Sub-County, Soroti District, in Eastern Uganda...

-

Mbuya organization gets $65m boost from MTN ..

MTN Uganda’s corporate social responsibility arm, MTN Foundation, has handed over a state-of-the-art computer lab to the Code Compass Foundation in Mbuya, Nakawa Division, as part of its ongoing effort to bridge the digital divide through its Digital Access Program...

-

Time to walk the talk about internet access ..

Last week, I revisited Uganda’s National Broadband Policy of 2018—and what I found was a compelling vision still waiting to be fully realised...

-

Judge acquits ThreeWays bosses over MTN's UGX14 bn theft..

In a ruling that has sent shivers through Uganda’s corporate and legal circles, Justice Lawrence Gidudu of the Anti-Corruption Court has acquitted two directors of ThreeWays Shipping Company who were charged with siphoning $3.8 million (about UGX14 billion) from MTN Uganda’s bank accounts...

-

MTN subsidiary unveils railway internet cable..

Bayobab Uganda, an MTN Group subsidiary, has unveiled its newest, shortest and fastest fibre optic route - from Malaba to Kampala, marking a significant expansion of digital infrastructure along the East African corridor...

-

President Museveni meets MTN top bosses at Entebbe..

President Yoweri Museveni has held a high-level meeting with a delegation from MTN Group at State House Entebbe. ..

-

UCC, telecoms join forces to end wire theft ..

The Uganda Communications Commission (UCC) has teamed up with MTN Uganda, Airtel Uganda, and ATC to launch a nationwide anti-vandalism campaign aimed at safeguarding the country’s critical telecom infrastructure including wires, cables and towers...

-

Govt, MTN moot ambitious digital inclusion agenda..

It’s not often that you find a room packed to capacity with the country’s top brains in the information, communication and technology (ICT) sector, and more so if they all representing public sector institutions such as Ministries, Departments and Agencies...

-

MTN to spend UGX500m on grassroots digital drive ..

MTN Uganda today kicked off the 2025 edition of 21 Days of Y’ello Care, the company’s annual employee volunteerism initiative. This year’s campaign, themed “Connecting at the Roots – Connecting Communities through Digital Tools,” is to run from June 1 to June 21, 2025, and focuses on sup..

-

MTN Y’ello Care campaign lights up Luwero..

MTN Mobile Money Uganda Ltd on Thursday extended its 2025 edition of the 21 Days of Y’ello Care campaign to Luwero District, marking the second major activation of this year’s employee volunteerism initiative...

-

MTN rallies minority owners for MOMO separation..

MTN Uganda has summoned its minority shareholders for an Extraordinary General Meeting to vote for a key decision to separate its mobile money business from the telecommunications company...

-

Alur Kingdom salutes MTN over community boost..

MTN Uganda has taken its flagship staff volunteerism initiative, the 21 Days of Y’ello Care, to the Alur Kingdom in Pakwach District, intensifying its commitment to community development with a focus on healthcare, digital inclusion, and youth empowerment...

-

MTN lifts up Busoga Kingdom young mothers..

MTN Uganda and its partners have today donated digital equipment and vocational tools to the Busoga Kingdom, reaffirming their commitment to bridging the country’s digital divide and empowering youth through practical skills development...

-

Put people at centre of digital roadmap - MTN chief..

Uganda’s Digital Transformation Roadmap, which envisions a future where digital tools drive economic productivity, efficiency in government, and inclusion across sectors, will only bear results if people are at the centre, a top MTN manager has said. ..

-

ICT’s UGX380 bn budget allocation welcome, but…..

The recent reading of Uganda’s 2025/26 national budget offers timely insight into the government’s development agenda, and one area that stands out is the renewed emphasis on digital transformation...

-

MTN Uganda boosts Halima's legends music gala..

MTN Uganda and MTN Mobile Money (U) Limited have proudly announced their sponsorship of the “Halima Namakula: Living Legends Gala”, reaffirming their commitment to celebrating and empowering local talent...

-

MTN passes out over 290 ICT girls in Gayaza..

MTN Uganda, in partnership with Smart Girls Foundation, has graduated 298 youths under the Girls in Tech and Girls with Tools initiatives, expanding efforts to reduce youth unemployment and close the digital skills gap in one of Africa’s youngest nations...

-

Minority owners overwhelmingly endorse MTN MoMo separation..

MTN Uganda Limited shareholders have overwhelmingly approved the proposed structural separation of its mobile money and fintech business, MTN Mobile Money (U) Limited (“MTN MoMo”), marking a significant milestone in the company’s strategic evolution into a fintech giant with global partners...

-

French media giant Canal+ takes over DStv, GOtv ..

French media conglomerate Canal+ has officially acquired full ownership of MultiChoice Group, the parent company of DStv and GOtv, in a landmark $3 billion (approx. 55 billion rand) deal. ..

-

MTN Uganda gives Sheema school new ICT lab..

MTN Uganda, through the MTN Foundation’s Digital Access Project, has today handed over a fully equipped ICT facility to St. John’s Secondary School Nyabwina in Sheema District, marking a major milestone in the telco’s efforts to bridge the digital divide in rural Uganda...

-

Google found guilty of breaching Ugandan data laws ..

In a notable decision with potential regional implications, Uganda’s Personal Data Protection Office (PDPO) on July 18 ruled that Google had violated Uganda’s Data Protection and Privacy Act. ..

-

Uganda can harness digital transformation agenda..

It is now evident that Uganda’s path to socio-economic transformation will not be driven by connectivity alone but by how that connectivity is translated into real value through platforms, digital tools, and strong public-private collaboration. ..

-

MTN Uganda to pay UGX224 Billion dividends..

MTN Uganda has posted strong financial results for the six months ended June 30, with total revenue climbing soaring to UGX 1.7 trillion. ..

-

Fighting cybercrime is a collective responsibility..

Every day, our service centres and call lines receive countless reports from customers who’ve fallen victim to fraud. People are tricked into sharing their PINs. ..

-

M-KOPA launches phone with health insurance cover..

M-KOPA, a leading fintech company, has officially launched an innovative smartphone offering that combines premium digital access with built-in financial services such as health insurance for low-income earners...

-

MTN, Turkish Airlines to reward prestige clients..

MTN Uganda, through its exclusive loyalty program MTN Prestige, has partnered with Turkish Airlines to launch an exciting new campaign, “Fly Prestige with Turkish Airlines,” offering loyal customers the chance to win free round-trip air tickets to destinations across the globe...

-

Gov’t salutes MTN on sustainability milestones..

The State Minister for ICT and National Guidance, Hon. Godfrey Baluku Kabyanga, has paid glowing tribute to MTN Uganda over the remarkable milestones it has achieved towards ensuring sustainable development in the country. ..

-

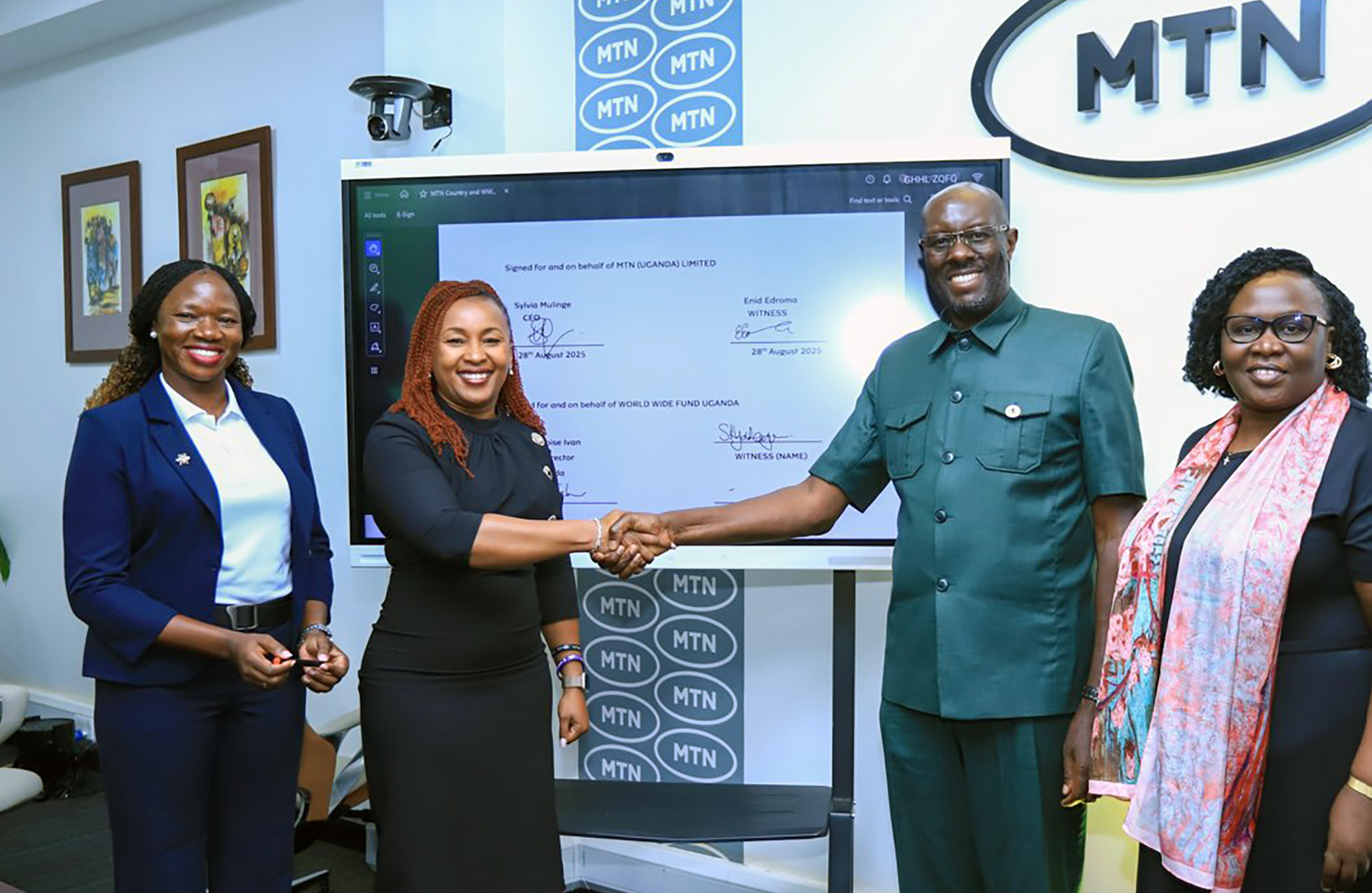

MTN, WWF launch climate change competition..

MTN Uganda in partnership with the World Wide Fund for Nature (WWF), has launched the Pachi Panda Innovation Challenge, a programme aimed at supporting young people to develop business ideas that address food, energy and water security challenges in the country...

-

NITA-U renews fight against rising cybercrime..

The National Information Technology Authority-Uganda (NITA-U), working with the Personal Data Protection Office (PDPO), has launched a nationwide campaign dubbed ‘Beera Ku Guard,’ aimed at reshaping how Ugandans think about cyber security, data protection, and privacy. ..

-

Gov’t holds talks with top MTN Group Fintech bosses..

MTN Group Fintech Directors are in Uganda for a high-level engagement with regulators and other key stakeholders. ..

-

New MTN MoMo campaign to promote kyeyo remittances..

MTN MoMo Uganda has launched a campaign aimed at expanding its footprint in the remittances market. The company has also rolled out seamless cross-border payments between Uganda and Tanzania and a new partnership with Dubai Duty Free to strengthen remittance services for Ugandans abroad...

Most Recent

UGX 38.61 Tn released for first half of FY 202..

The Government has achieved 53.4% budget execution for the first half of the 2025/26 financial year,..

Uganda incurs UGX13 Tn export losses - report..

Uganda is losing up to $3.5 billion (UGX 13 trillion) every year in perishable agricultural exports ..

UDB gets UGX104 Billion to power SME growth ..

The Uganda Development Bank (UDB) has clinched a USD30 million (UGX 104 billion) financing facility ..

August coffee exports set new 838,000 bags re..

Uganda’s coffee industry soared to new heights in August 2024, earning UGX820 billion from exports..

KK Security rebrands to GardaWorld Security..

KK Security has officially transitioned to GardaWorld Security in Uganda, marking a significant shif..

Digital skills for youth must be an urgent pri..

"I can’t believe this is happening! We have computers now!" exclaimed Aisha Nakalema, a student at..

MTN offers girls’ skilling initiative UGX270..

Smart Girls Foundation, a Kasangati-based girls’ skilling initiative, is set to receive an additio..

- Top Story

Manufacturers task Gov't, banks on high intere..

The Government wants commercial banks to lower the interest rates they charge manufacturers so as to..

- Top Story

MTN scoops fastest internet award..

Ookla, the global leader in internet testing and analysis, has announced MTN Uganda as the Fastest M..

BoU to review StanChart’s exit plan from Uga..

The Bank of Uganda (BoU) is set to assess a proposal from Standard Chartered Bank Uganda regarding t..

Anxiety as donor aid taps shrink further..

During the recent presentation of the Budget Strategy for the Financial Year 2025/2026, officials fr..

Kidepo National Park to get posh airport, hote..

The Government of Uganda has reached an agreement with the Sharjah Chamber of Commerce and Industry,..