Healthcare for children is a critical responsibility - Musiime

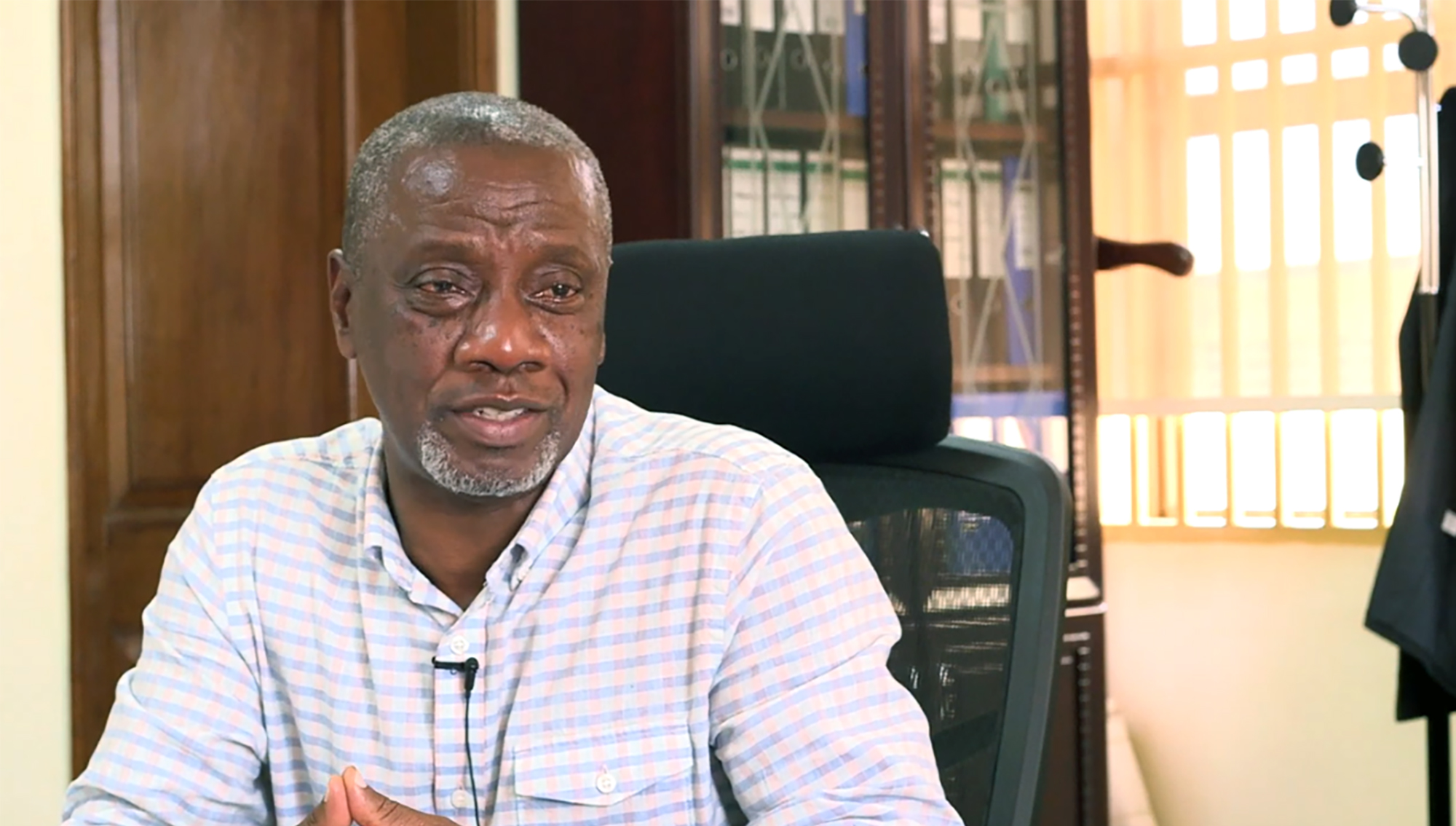

Dan Musiime, CEO, Jubilee Health Insurance.

Jubilee Health Insurance Ltd recently launched the J-Junior Medical Cover, a stand-alone product aiming at covering the health needs of children under the age of 17 years. Business Edge spoke to Dan Musiime, the CEO of Jubilee Health Insurance, about the rationale for the new product.

What prompted Jubilee to develop this product?

Our mandate is to provide health insurance services and ensure that those services reach the people or populations that need them most. Following extensive research and review of various publications, we realized a significant issue in Uganda: infant mortality. Many children under the age of five are not surviving due to preventable diseases, primarily because their parents cannot access affordable healthcare. This gap in healthcare services led us to develop a product targeting these vulnerable children, who represent our next generation.

We observed that more than 95% of health insurance policies in Uganda are geared towards the corporate sector, which sometimes doesn't cover dependents beyond the primary employee. Recognizing that many families have more than one child, we believed parents should have the opportunity to purchase affordable insurance for their children.

In addition to addressing infant mortality, our efforts align with the government's agenda by supplementing public health services. The government's healthcare system is stretched thin, so we are complementing their efforts by providing private sector solutions to reduce mortality rates. This initiative is a collaborative effort with the government, aiming to ensure a healthier future for Uganda's children.

Why is it crucial to focus on health service delivery to children?

Healthcare is fundamental for children as it impacts their ability to grow, learn, and become responsible citizens. Healthy children can attend school and eventually contribute to society. By addressing healthcare needs from a young age, we ensure that they develop into healthy adults who can drive our economy forward. Preventing diseases and promoting wellness from the start is key to building a healthier, more productive generation.

If you look at statistics, you would note that the gap in healthcare funding for children is significant. Currently, the private health insurance sector covers about 400,000 lives in total, which is a small fraction of the population.

Most of these are corporate employees and their dependents. This means that a large number of children, especially those in the informal sector, are not covered. They rely on out-of-pocket expenses, which can be financially crippling for families.

How does your investment in the healthcare sector, specifically in reducing infant mortality, tie into the government's agenda?

We are eagerly anticipating the enactment of the National Health Insurance Bill, which would ensure all citizens have access to healthcare. In the meantime, as a private sector entity, we are doing our part by supporting the government's efforts. The public health system is overstretched, so we are supplementing these efforts by providing additional resources and services.

By offering medical insurance, we help relieve some of the government's burden, ensuring that more children can access the necessary healthcare. This effort is about monetizing the economy while ensuring we maintain a healthy generation of future leaders. As we extend medical insurance to more people, we complement the government's efforts and contribute to a healthier population.

How then do you measure and evaluate the impact of your input?

While it is too early to provide precise figures, we plan to track the number of lives touched and the medical assistance provided through our insurance policies. As more people purchase and utilize our products, we will gather data on how many lives are impacted and how much medical assistance is accessed. This will help us evaluate our contribution to reducing infant mortality and improving healthcare access.

As such, our evaluation will be based on the number of lives we touch and the extent of medical assistance provided. For instance, by the end of this year, we aim to assess how many people have benefited from the insurance and the coverage they received. This data will help us measure our impact and make necessary adjustments to improve our services.

That said, since we started offering medical insurance products in 2007, we have insured about 100,000 lives and paid out claims worth UGX70 billion annually. This has significantly alleviated the financial burden on families. We've also introduced products for senior citizens and individuals in the diaspora, ensuring a wider range of people have access to healthcare. These contributions have made a substantial impact, and we continue to strive for greater reach and effectiveness.

Do you plan to extend your products to the informal sector given that it houses a large segment of the population?

We recognize the need to cater to the informal sector, which often includes low-income households. Our research and development teams are working on creating micro-insurance products that are affordable and meet the needs of this market segment. These products will have lower price points, making them accessible to a broader audience, and ensuring that more children receive the healthcare they need.

In developing our products, we segment the market to meet the needs of different groups, including the informal sector. This sector often represents the lower end of the economic pyramid, so we are developing affordable microinsurance products that can cater to their needs.

Has there been any progress in collaborating with the government to enhance healthcare access and adoption of health insurance?

While we are in the early stages of discussions with the government, we believe collaboration can significantly enhance healthcare access. For instance, if the government covers certain treatments like malaria, we could exclude these from our packages, making our products more affordable.

This type of cooperation could help us provide more comprehensive coverage to a larger population. We work through our association, the Uganda Insurance Association (UIA), and with the regulator, the Insurance Regulatory Authority (IRA), to advance these discussions for the greater benefit of the population.