3rd Party Insurance carries many benefits - Insurers’ Association

Mr. Kisakye argues that even for the Government, failure to secure insurance leads to losses.

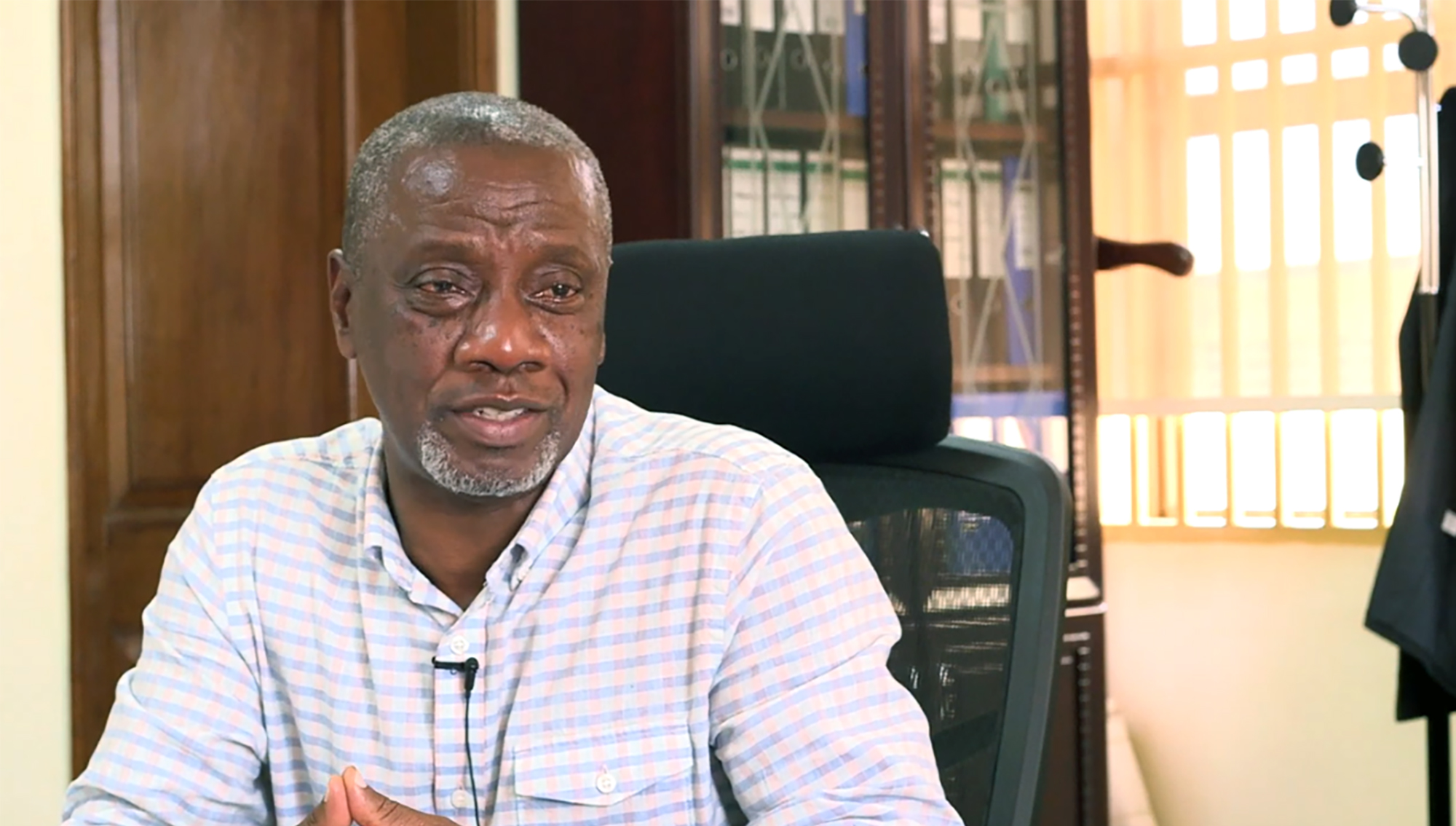

The Uganda Insurers’ Association (UIA) has launched a new campaign, christened Vuga ku Sure aimed at promoting the uptake of Motor Third Party Insurance across the country. Business Edge caught up with CEO Jonan Kisakye to shed more light on the campaign. Excerpts.

From an insurer’s perspective, is there a difference between motor insurance and third-party insurance?

Certainly. As a vehicle owner, you possess an asset, but as you use the vehicle, you expose other road users to risks. Third-party insurance covers bodily injuries or death caused to others, while motor insurance covers physical damage to your vehicle, whether it's due to an accident, fire, or theft. It's crucial for customers to understand what they are buying and the benefits they are entitled to.

They shouldn't wait for an accident to learn about the claims process. They should engage with their insurer immediately after purchasing the policy to understand their responsibilities.

What are the consequences of intentionally or ignorantly refusing to pay for third-party insurance?

Not paying for third-party insurance is against the law. According to the law, using a vehicle on the road without valid third-party insurance is an offense punishable by a fine not exceeding UGX100,000, imprisonment for up to two years, or both. The law aims to ensure that vehicle owners are responsible and accountable.

You recently launched a campaign dubbed Vuga ku sure. What is the key message and spirit behind this campaign?

The key message behind our campaign is to educate the public about the importance and benefits of motor third-party insurance. Despite the law mandating it, many people do not understand its significance. Motor third-party insurance provides social protection by covering liabilities in case of accidents, ensuring that victims receive appropriate compensation.

Our campaign aims to increase awareness and appreciation of motor third-party insurance. We want people to understand that it is not just a legal requirement enforced by the police but a crucial aspect of social protection. It is meant to protect not only the policyholder but also other road users.

Are the Ugandan the public sufficiently enlightened about motor third party insurance?

Well… many people do not understand how insurance works or the benefits it provides. They see it as an unnecessary cost rather than a vital safety net. This lack of understanding often leads to practices like bribing, which is more expensive than purchasing insurance. Our campaign aims to address these misconceptions and educate the public about the true value of insurance.

I understand that some people have a problem with the 15% stamp duty that goes to URA, but this is part of the overall cost of motor third-party insurance, which includes the basic premium and taxes.

The basic premium is the amount the insurance company depends on to pay claims. A significant portion of the premium goes to the government as taxes. However, we have engaged with the government to discuss ways of reducing the tax burden to make insurance more affordable. While the government needs to collect taxes, we hope they will consider ways to lower these costs to encourage more people to take up insurance.

But many policyholders argue that the cost of chasing after that money is ridiculous, and eventually, many don’t pursue it. Do insurers complicate the process intentionally?

The law puts the responsibility on the owner of the vehicle to notify the insurer if there's an accident. As a vehicle owner, driver, or motorcycle rider, you must ensure the injured party is taken to the hospital and notify the police and your insurer.

The insurer will then provide a list of required documents for the claim, which may include hospital bills, death certificates, etc. The process is open and transparent, and I believe it is not intended to confuse anyone.

However, I also agree that the process is a bit ridiculous and the compensation amounts are too small. But, we are in the process of amending the law, to make the process more streamlined and the money more reasonable.

So, in case of an accident, what steps should be taken by the policy holder to process a claim?

First, notify the Police and ensure the injured party receives medical attention. Then, notify your insurer and provide the required documents. Many people are unaware of their responsibilities under the law, which includes working with the insurer to ensure all necessary documents are submitted.

The insurer will guide you through the claims documentation process. This can be streamlined using digital platforms, making it easier to handle claims, including payments via mobile money and other platforms. This system reduces the hassle of visiting police stations or insurer branches.

From where you sit, what is the claims culture of Ugandans for motor third party insurance like?

The public is generally more aware of insurance for homes, assets, and life. However, motor insurance, often bought to fulfill legal requirements, faces challenges. People are not very positive about the claims process because of the limitations and low compensation limits. We're working on increasing the liability limits and introducing property damage coverage.

This will make insurance more comprehensive and beneficial for the insured. We're also advocating for government vehicles to be insured, which currently isn't the case, adding to the challenge. Remember, the government is a major fleet owner, and their participation in insurance is crucial. We're crafting a national insurance policy to streamline this process. This policy will guide how government insurance is conducted, potentially increasing overall insurance uptake. We have been telling our members that the insurance sector needs to offer tailored solutions to the government.

Traditional insurance models may not be suitable, so we're exploring options like government-operated funds to cover specific liabilities. This approach can demonstrate the value of insurance to the government and encourage broader participation.

So, you're looking at all asset classes and not just focusing on one thing. What solutions do you offer from an insurance perspective to the government?

Government operates with annual budgets, and they budget for assets like vehicles. Our role is to demonstrate to them that insurance can save them money. For instance, recently I was at a function where they were launching new marine vessels.

They had previously operated vessels, but the engines were stolen, and they had to replace them instead of increasing the fleet. This shows how a lack of insurance leads to losses. Imagine if a fire were to break out at the Parliament or State House, the consequences would be severe. This is why the government needs to understand the value of insurance.