Insurers facing more scrutiny on their ESG practices

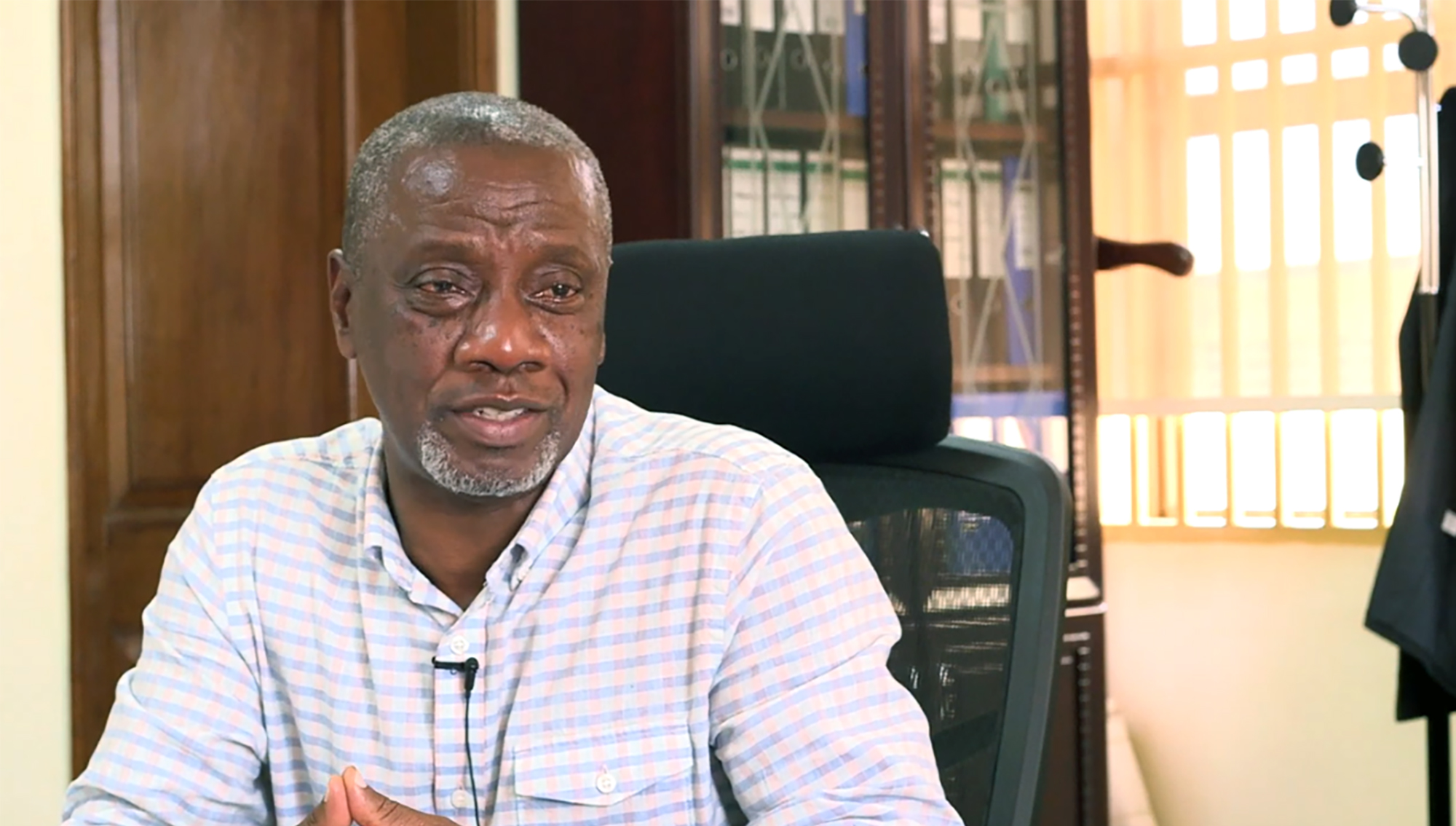

Mr. Joseph Osaka, Chief Financial Officer, GA Insurance Uganda

In today’s business world, companies are increasingly being judged, not just on their financial performance, but also on their environmental, social, and governance (ESG) practices. Insurance companies also now face greater scrutiny regarding their impact on the environment, their corporate governance practices, and their contributions to social well-being. Mr. Joseph Osaka, the Chief Financial Officer of GA Insurance spoke to Edward Kayiwa about this significant transition. Excerpts.

To what extent is ESG integration important in the insurance industry?

ESG integration involves incorporating environmental, social, and governance (ESG) metrics into a company’s financial reporting. For the insurance industry, this practice is crucial as it allows insurers to evaluate and disclose their broader impact on the environment, society, and governance structures.

This transparency helps attract conscientious investors, meet regulatory expectations, and align with global sustainability goals. Companies now face greater scrutiny regarding their impact on the environment, corporate governance practices, and contributions to social well-being. This shift is driven by growing awareness among stakeholders and regulatory bodies, prompting insurance companies to adopt more transparent and responsible practices.

How does environmental sustainability fit into ESG for the insurance sector?

Environmental sustainability in the insurance sector involves assessing how a company’s operations affect the environment and what measures are being taken to mitigate the negative impacts. For example, insurers might evaluate the environmental implications of their coverage policies.

Companies are increasingly offering insurance for ‘green’ initiatives, such as agriculture insurance for farmers practicing sustainable farming methods. These measures not only help protect the environment but also align the company with global sustainability goals.

What role does social responsibility play in ESG for insurance companies?

Social responsibility in the context of ESG for insurance companies encompasses their interactions with the broader community. This includes activities that benefit society at large, not just direct stakeholders.

For instance, insurers might evaluate the social impact of their policies on communities, such as how insurance coverage for an individual or family indirectly benefits the wider community. This promotes overall social well-being and reflects the company’s commitment to social responsibility.

What challenges do insurance companies in Africa face when adopting ESG principles?

Adopting ESG principles poses unique challenges in Africa, where businesses have historically been slow to adopt international standards like the International Financial Reporting Standards (IFRS).

Similar resistance can be seen with ESG adoption. However, as the benefits of ESG integration become more apparent, there is a gradual shift towards embracing these practices. Companies are beginning to realize that ESG principles can enhance their reputation, attract investment, and ensure long-term viability.

How has integrating ESG metrics into financial reporting impacted the financial performance of GA Insurance in Uganda?

The integration of ESG metrics into financial reporting has significantly enhanced the financial performance of GA Insurance Uganda. Last year, GA Insurance achieved a remarkable 10% growth in its performance. This growth positioned us as key players in Uganda's insurance industry.

Our gross written premium (GWP) soared to UGX23.6 billion, placing us among the top 15 insurance providers in the market with a 2.5% market share. We also reported a commendable profit before tax (PBT) of approximately UGX2.3 billion for the year.

That said, we have identified several key sectors driving economic growth in Uganda, including services, agriculture, and hospitality, as well as the oil and gas industry. As part of our approach, we have actively aligned our product offering to cater to the evolving needs of these sectors, ensuring comprehensive coverage and support for businesses and individuals.

As GA Insurance, what has your experience been like in integrating and enforcing ESG?

Integrating and enforcing ESG practices has been a transformative journey for GA Insurance Uganda. As an insurance service provider, we recognize that ESG integration is essential for sustainable growth and long-term success. We have made significant strides in minimizing our environmental footprint and promoting sustainability.

Our initiatives include reducing energy consumption in our offices, encouraging paperless transactions, and supporting renewable energy projects. By offering insurance products tailored to sustainable practices, such as agriculture insurance for farmers practicing eco-friendly methods, we contribute to environmental preservation and align with global sustainability goals.

GA Insurance Uganda understands the importance of social responsibility and actively engages with local communities to foster social well-being. We support community development programs focused on education, healthcare, and poverty alleviation. Initiatives such as offering affordable insurance products to low-income families and sponsoring educational scholarships ensure their business practices benefit society broadly. We emphasize robust corporate governance, ensuring transparency, accountability, and ethical business practices. Looking ahead, our plan is to expand green insurance products, further reduce the carbon footprint, and increase investment in community development projects. By staying ahead of industry trends and continually enhancing their ESG strategies, GA Insurance Uganda is committed to driving positive change and contributing to a sustainable future for Uganda and beyond.

What activities is GA Insurance Uganda carrying out in relation to ESG?

GA Insurance Uganda's Environmental, Social, and Governance (ESG) plan encompasses a variety of activities designed to promote sustainability, support local communities, and uphold strong governance practices.

For instance, our green office initiative involves implementing energy-efficient systems in our offices to reduce carbon emissions, encouraging paperless transactions to minimize paper waste, and promoting recycling programs within our office premises.

We also offer sustainable insurance products that support renewable energy projects, providing agriculture insurance for farmers who practice sustainable farming methods, and developing policies that incentivize eco-friendly practices among clients. On the social side, we are investing in healthcare initiatives such as health camps and medical aid for underserved communities, and running poverty alleviation projects to support low-income families. Furthermore, we have also developed affordable insurance products tailored for low-income families and individuals, and offering microinsurance to help small businesses and entrepreneurs manage risks.