Streamlining insurance operations through ICTs

Onen says they plan to introduce new products and offerings so as to meet the evolving needs of the market.

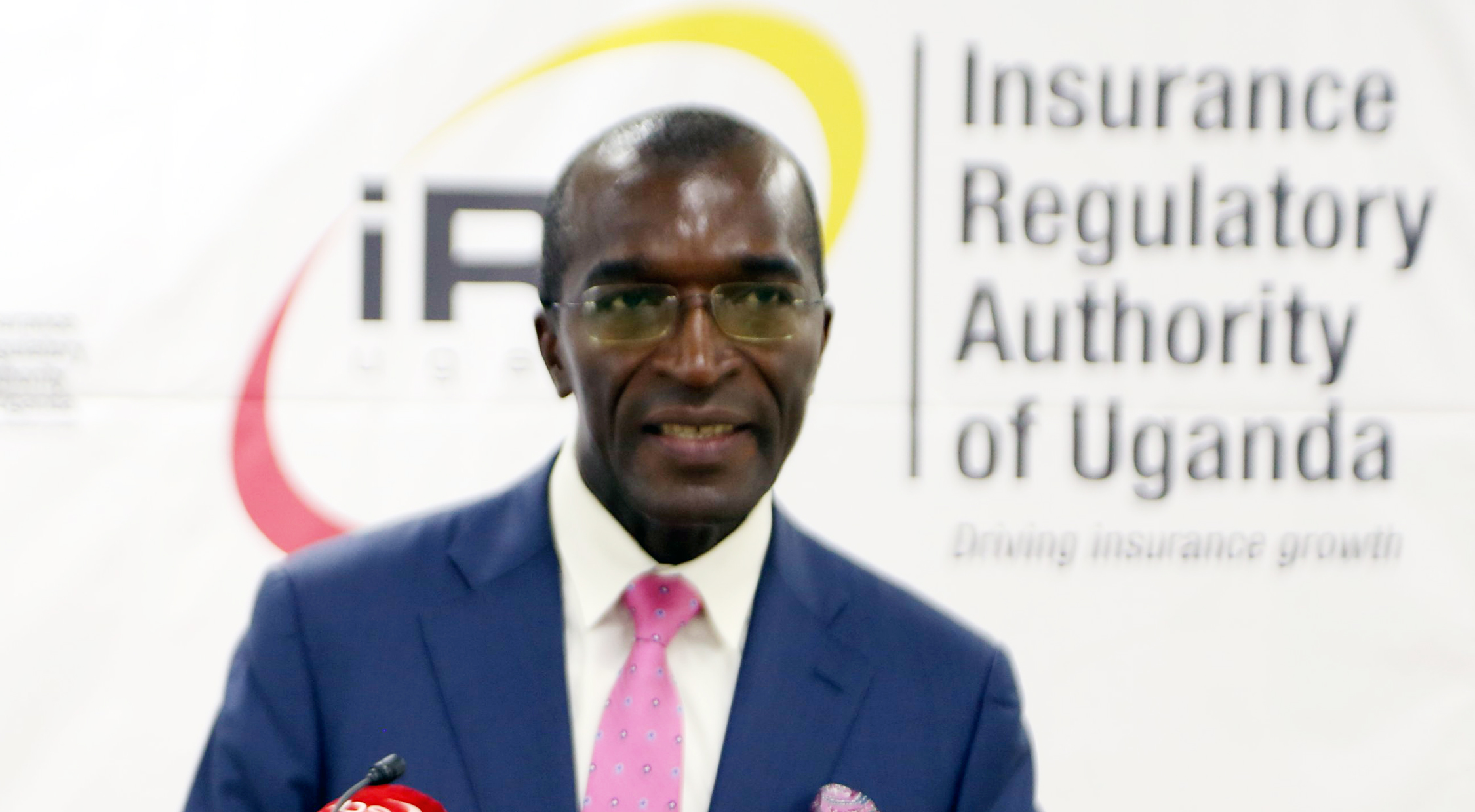

Minet Uganda, an insurance company, has made a significant leap by entering the reinsurance sector, expanding its range of services and reinforcing its position in Uganda's insurance industry. Business Edge sought out Alex Onen, the Minet Reinsurance CEO, to discuss the development. Excerpts

What is Minet’s background and what motivated the decision to establish Minet Reinsurance?

Our journey in reinsurance began in Kenya in 2015, and after seeing success there, we expanded to Botswana, Lesotho, and now Uganda. The decision to enter these markets was driven by the need to diversify our income streams and address the existing gap in reinsurance services.

We want to leverage our extensive experience in direct insurance broking and identify new opportunities within the insurance sector. We recognized that the reinsurance market in Uganda, and indeed several African countries, was underdeveloped.

How does this new subsidiary distinguish itself in the reinsurance market, especially this market where there are a number of established brands?

We distinguish ourselves through our global partnerships and extensive experience. We offer specialized reinsurance solutions across various sectors, including oil and gas, by providing comprehensive coverage from the largest operations down to subcontractors.

Our partnerships with international experts allow us to deliver top-notch solutions and access global markets, which gives us a significant edge over our competitors. At the moment, we see the low penetration rates as a tremendous opportunity. Our focus is on supporting insurance companies by offering solutions that help them grow their portfolios. By addressing niche and complex risks and enhancing the overall insurance landscape, we aim to drive market growth and increase penetration over time. We’ve noticed a positive response from the market and identified numerous areas where we can provide value, particularly in niche markets like oil and gas.

That said, remember that competition is a natural part of the industry, and we embrace it as it drives us to improve continuously. Our competitive edge comes from our global partnerships, which allow us to offer faster and more specialized solutions. By focusing on delivering high-quality services and building strong relationships with clients, we ensure that we stand out in the market. Additionally, our collaboration with the Minet Africa group provides us with valuable insights and access to resources.

Which reinsurance solutions does Minet offer to the oil and gas sector, especially at a time when everyone is talking is about oil and the EACOP project?

We provide tailored solutions across the entire oil and gas value chain. This includes coverage for everything from drilling operations to auxiliary services. Our experience and partnerships enable us to handle complex risks and offer comprehensive coverage that meets the industry's specific needs.

Remember, whereas we have the Uganda Insurance Consortium taking parts of the risk, the other part of the risk will be re-insured.

What challenges have you faced in entering the reinsurance market, and how are you addressing them?

The major challenge is the complexity and speed of processing claims and providing solutions. To address this, we've invested heavily in technology to streamline our operations and improve turnaround times.

Additionally, our extensive regional presence across nine countries allows us to leverage local expertise and adapt solutions quickly. The other challenge is perhaps fraud, but we have implemented robust due diligence processes and work closely with reputable markets to ensure that we offer the right solutions.

Our risk management strategies include recommending thorough audits and cybersecurity measures to mitigate risks. We also provide advice on how to manage and minimize fraud risks effectively.

What are Minet Uganda’s growth ambitions in the reinsurance sector over the next few years?

Expanding into reinsurance is an opportunity for us to help spur Uganda’s economic growth, especially, in light of the coming five years.

Over the next few years, we aim to achieve a 30% growth in our market share. Our strategy involves continuing to provide top-notch solutions and capacity for complex placements, particularly in the oil and gas and infrastructure sectors. We plan to introduce new products and expand our offerings to meet the evolving needs of the market. We are also focusing on developing innovative products for complex risks and large-scale sectors like energy and infrastructure.

Insurance is a critical aspect of risk management, and without it, economic development is challenging because there’s no fallback when things go wrong. By providing reinsurance solutions, we help insurance companies manage their risks better, which in turn supports overall economic stability and growth in Uganda.