IMF projects modest global growth amid persistent inflation

The International Monetary Fund (IMF) has projected modest global economic growth over the next two years, driven by various regional dynamics, but cautioned about numerous risks that could derail this path.

In its latest update to the global economic outlook released on Tuesday, the IMF highlighted that while the United States is experiencing a slowdown, Europe appears to be bottoming out, and China is seeing a surge in consumption and exports. However, the momentum in combating inflation is waning, which might delay interest rate cuts and maintain the pressure of a strong dollar on developing economies.

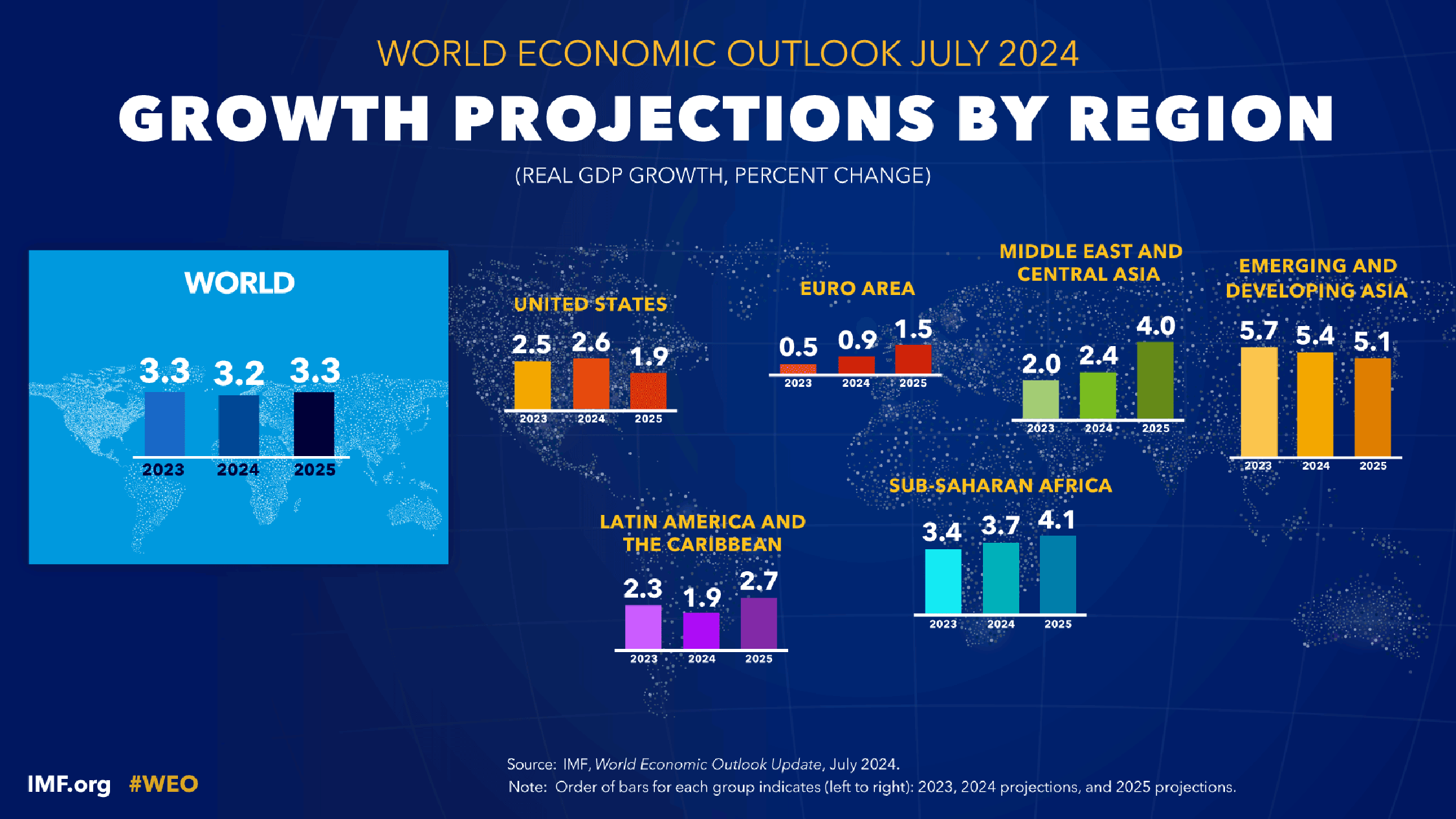

The IMF maintained its forecast for real global GDP growth in 2024 at 3.2 percent, unchanged from its April prediction, and slightly increased its 2025 forecast by 0.1 percentage point to 3.3 percent.

- Despite these updates, the growth levels are still insufficient to alleviate concerns of prolonged economic stagnation, a scenario IMF Managing Director Kristalina Georgieva has likened to the "cool 20s."

The forecast for growth in sub-Saharan Africa is revised downward, mainly as a result of a 0.2 percentage point downward revision to the growth outlook in Nigeria amid weaker than expected activity in the first quarter of this year.

Generally, the updated forecasts indicate some regional shifts among major economies. The IMF cut its 2024 growth forecast for the United States by 0.1 percentage point to 2.6 percent, citing slower-than-expected consumption in the first quarter.

- The 2025 growth forecast for the U.S. remained unchanged at 1.9 percent, reflecting a slowdown driven by a weaker labor market and reduced spending in response to tighter monetary policy.

IMF Chief Economist Pierre-Olivier Gourinchas noted in a blog post accompanying the report that growth in major advanced economies has become more synchronized as output gaps have narrowed. He pointed out that signs of a slowdown are increasingly evident in the United States, while Europe is showing signs of recovery.

These varying regional dynamics underscore the complexity of the global economic landscape and the challenges in navigating the path to sustained growth.

“As the eight decades since Bretton Woods have shown, constructive multilateral cooperation remains the only way to ensure a safe and prosperous economy for all,” he said.

The report also shows that Inflation is expected to remain higher in emerging market and developing economies (and to drop more slowly) than in advanced economies. However, partly thanks to falling energy prices, inflation is already close to pre-pandemic levels for the median emerging market and developing economy.

Similar Posts You May Like

-

.jpeg)

DTB SCOOPS THE MOST INNOVATIVE BANCASSURANCE AGENT 2022 AWARD..

Diamond Trust Bank – DTB has been named the Most Innovative Bancassurance Agent in Uganda for the year 2022 at the prestigious Insurance Innovations Award -2022 held that the Kampala Serena Hotel. DTB was voted the most innovative Bancassurance Agent because of its innovation in the use of Digit..

-

MTN Uganda delivers on promise to President Yoweri Museveni, successfully mo..

Wednesday 6th September 2023. Kampala, Uganda. MTN Uganda has fulfilled President Yoweri Museveni's call to action, rallying South African investors to explore opportunities in Uganda. This remarkable achievement follows the successful conclusion of the second leg of the Uganda-South Africa summ..

-

President Yoweri Kaguta Museveni on Use ICT to Build Our Economy..

President Yoweri Kaguta Museveni has cautioned Ugandans against using Information And Communications Technology (ICT) to promote importation of goods. President Museveni said Ugandans should use ICT to promote the buying of goods and services within Uganda or promote selling to outsiders but not vic..

-

There is a ready market, Museveni assures Foreign Investors..

President Yoweri Kaguta Museveni has wooed foreign investors to invest in Uganda, saying that the East African country has a lot of investment opportunities with a readily available market...

-

Uganda Listed Among Top Kyeyo Cash Recipients..

A new report by the World Bank has shown that Uganda is among the top ten recipients of money from nationals working abroad, commonly referred to as 'kyeyo' cash, in Sub-Saharan Africa...

-

President Museveni Takes Over Chairmanship Of G77 + China..

Uganda has assumed the chairmanship of the Group of 77 plus China (G77+China)...

-

URA tasked to sensitise traders on how Electronic Fiscal Receipting and Invo..

In January 2021, URA implemented EFRIS to tackle tax administration issues associated with business transactions and receipt issuance...

-

UBL sets up UGX20 billion cleaning facility ..

Uganda Breweries Limited, the maker of Tusker and Guinness, has commissioned a state-of-the-art effluent treatment plant, which officials said marks a significant milestone in the company's commitment to sustainability and reducing its carbon footprint...

-

Physical planners' body warns on quacks as new Council is elected..

Members of the Society of Professional Physical Planners of Uganda have elected new leaders as the government moves in to crackdown on imposters in the physical planning field...

-

URA now to deploy drones in smuggling fight..

The Uganda Revenue Authority (URA) has said they are to invest in surveillance drones at porous border points in an effort to curb the vice of smuggling. ..

-

Economic uncertainty as Uganda’s credit rating is downgraded..

Global credit rating agency Moody’s Ratings has downgraded Uganda’s long-term foreign-currency and local-currency issuer ratings to B3 from B2, a development that implies that going forward Uganda’s bonds would be less attractive to international investors and the government would have to borr..

-

Address drivers of rising national debt - experts..

Uganda’s debt risks are becoming more pronounced both in the short to medium term, largely attributed to poor debt utilization as one of the key causes of the nation's mounting public debt stock...

-

Tomatoes, vegetables push inflation to 3.6%..

The escalating prices of tomatoes and fresh vegetables have been the primary drivers behind the rise in headline inflation rate in May. ..

-

BoU maintains CBR at 10.25% as inflationary pressures persist..

Bank of Uganda has kept its key rate unchanged at 10.25% in June unlike in the previous month when it was raised from 10%, which was prompted by rising inflation and significant depreciation of the Ugandan shilling against major currencies...

-

Uganda acquires $500m loan from S.Korea..

Uganda has signed an agreement with South Korea for a $500 million loan to help finance infrastructure building in the east African country, Uganda's finance ministry has said...

-

Survey shows private sector improvement in May..

The month of May saw a further improvement in the private sector’s performance, according the Stanbic Bank Purchasing Managers’ Index (PMI). ..

-

Stop budgeting for corruption, CSOs tell MPs..

In a stirring call to action, Civil Society Organizations (CSOs) want Members of Parliament to eliminate budget allocations that enable corruption. ..

-

Museveni sets up outfit to fight URA corruption..

President Yoweri Museveni has set up a new unit at State House, aimed at keeping an eye on Uganda Revenue Authority and curb corruption in the tax administration system...

-

EU, Enabel boost refugees with vocational skills..

More than 5,000 youth in refugee communities in the West Nile Region have been passed out after receiving vocational skills aimed at boosting their self-employment opportunities and household incomes. ..

-

Planning Authority warns on surging population..

The National Planning Authority has expressed concern about Uganda’s population, which has surged by 11.3 million since the last census...

-

Uganda boosts diplomatic, trade ties with France..

The Deputy Speaker of Parliament, Thomas Tayebwa, has hailed the cooperation between Uganda and France in the areas of trade, investment and diplomatic relations as a formidable uniting factor that ought to be fostered for further growth...

-

Optimism as COMESA-EAC-SADC free trade area starts..

The COMESA-EAC-SADC Tripartite Free Trade Area (TFTA) Agreement officially came into force following ratification by the requisite number of member States. ..

-

Embassy of Norway to officially close next week..

Ugandans are set to feel the pinch as of lost jobs and business services as the Norwegian Embassy in Kampala officially closes its doors next week on July 31. ..

-

Concern over fewer girls in vocational institutions..

The low enrolment and completion rates for girls in Uganda’s Technical Vocational Education and Training (TVET) programmes should be a serious concern for policy makers and implementers, according to a new report. ..

-

Uganda nets UGX 80 billion from visa fees..

The Directorate of Citizenship and Immigration Control (DCIC) has reported a substantial increase in revenue from visa visa fees for the 2023/2024 fiscal year, totalling over UGX80 billion, up from UGX45 billion in the previous year. ..

-

Inflation hits highest level in 12 months..

High cabbage, fish and Irish potatoes prices were the primary drivers of the 4% annual inflation in July, the Uganda Bureau of Statistics (UBOS) has indicated as per the July Consumer Price Index (CPI). ..

-

Optimism as Central Bank cuts key rate to 10%..

The Bank of Uganda (BoU) has slashed the Central Bank Rate (CBR) by 25 basis points to 10%, a development that experts say would have significant implications for the banking sector and broader economic landscape in the country...

-

UBOS reports rise in August inflation..

The Uganda Bureau of Statistics (UBOS) has released the Consumer Price Indices and Inflation report for August 2024, highlighting a slight increase in monthly inflation and a noticeable rise in the prices of certain commodities, particularly mangoes and oranges. ..

-

Gov’t arrears threaten URA performance..

Uganda's revenue collection is facing a serious threat from the growing backlog of government arrears, which is straining the Uganda Revenue Authority’s (URA) ability to meet its targets. ..

-

Amongi drops Dr. Kimbowa from NSSF Board..

Gender, Labour and Social Development Minister Betty Amongi has appointed David Ogong as the new chairperson of the new Board of Directors for the National Social Security Fund (NSSF), replacing Peter Kimbowa whose contract was not renewed...

-

2025/26 budget strategy to focus on four pivotal sectors ..

The Government is outlining an ambitious strategy for the 2025/2026 fiscal year, aimed at steering the country towards a fully monetized and formalized economy...

-

URA exceeds August target by UGX27 billion ..

The Uganda Revenue Authority (URA) has reported an impressive performance for August, with revenue collections surpassing the set target. ..

-

IMF cautions Ugandan banks over treasury bonds..

In a new report, the International Monetary Fund (IMF) has warned commercial banks against overreliance on Government securities saying it raises serious financial concerns for the country’s economy...

-

Anxiety as donor aid taps shrink further..

During the recent presentation of the Budget Strategy for the Financial Year 2025/2026, officials from the Ministry of Finance, Planning and Economic Development warned that dwindling external financing down by approximately 30% from UGX 4.4 trillion (about $1.2 billion) in 2022 to an estimated UGX3..

-

EADB launches UGX68 bn fund for Ugandan SMEs..

The East African Development Bank (EADB), the region’s leading development financial institution, has launched a new $15 million (about UGX68 billion) fund to support the growth of 1,500 rural-based Small and Medium Enterprises (SMEs) in Uganda. ..

-

Charcoal hikes September inflation by 0.2%..

Uganda experienced a notable increase in inflation in September 2024, as headline inflation rate soared by 0.2%, consistent with the previous month. ..

-

EADB gets positive credit ratings review..

The East African Development Bank's (EADB), the region’s premier development financial institution, has received positive credit results from a review of its credit ratings, raising hopes that borrowers would continue to borrow at more favourable interest rates...

-

BoU slashes key rate to 9.75% from 10.25%..

The Monetary Policy Committee (MPC) of the Bank of Uganda has announced a significant reduction in the Central Bank Rate (CBR), lowering it by 25 basis points to 9.75%. ..

-

Optimism as national economy registers 6.6% growth..

Optimism as national economy registers 6.6% growth..

-

Uganda gets positive IMF growth projection..

The International Monetary Fund (IMF) has painted a positive picture of Uganda’s economic growth prospects, posting a 5.9% growth projection, according to the latest World Economic Outlook report, which is above the average of 4.2% for Sub-Saharan Africa...

-

Optimism as Uganda nears full BRICS nod..

Uganda has become one of the two African countries that have been admitted into the BRICS alliance in the category of ‘partner states.’..

-

US election: Africa hoping for the better..

Voters in the United States today go to the polls to choose the 47th president of what is the world’s largest economic and military superpower, in an election that is not only tight in the US, but is also being closely watched around the world, including Africa...

-

Likely implications of Trump return for Africa ..

Across Africa, Donald Trump’s forth-coming second term holds various implications for the continent and its development agenda. The United States remains an important partner in Africa’s growth. Through initiatives like the African Growth and Opportunity Act (AGOA) and the Millennium Challenge C..

-

Uganda among top 20 FDI destinations in 2024 ..

Uganda has been named among the top 20 investment destinations on the African continent in 2024...

-

Exports slump as coffee crisis bites..

A new report by the Ministry of Finance, Planning and Economic Development has indicated that Uganda’s export earnings dropped by UGX 410.4 billion in September. ..

-

Civil society welcomes nationwide school-feeding plan..

Civil society organisations (CSOs) have welcomed the setting up of a national multisectoral working group to guide the implementation of the national school feeding initiative next year. ..

-

Kenyan envoy hails economic diplomacy, cooperation..

The Kenyan High Commissioner to Uganda, Joash Maangi, has acknowledged the enduring "brotherhood" between Kenya and Uganda, which he said has significantly contributed to mutual progress. ..

-

Optimism as October exports surge to UGX2.7 trillion ..

Uganda’s export earnings surged to US$744.86 million (approximately UGX2.7 trillion) in October 2024, marking a 9% increase from US$682.69 million (UGX2.47 trillion) in September. ..

-

Uganda now officially BRICS partner country ..

BRICS, the Global South-led forum for economic cooperation, continues to grow in influence, as it seeks to de-dollarize and transform the international monetary and financial system...

-

UGX20 Billion squandered in pension scam ..

The Auditor General’s report for the year ending 2024 has unveiled alarming financial irregularities in the management of pension and gratuity benefits, revealing over UGX 20 billion in overpayments to beneficiaries. ..

-

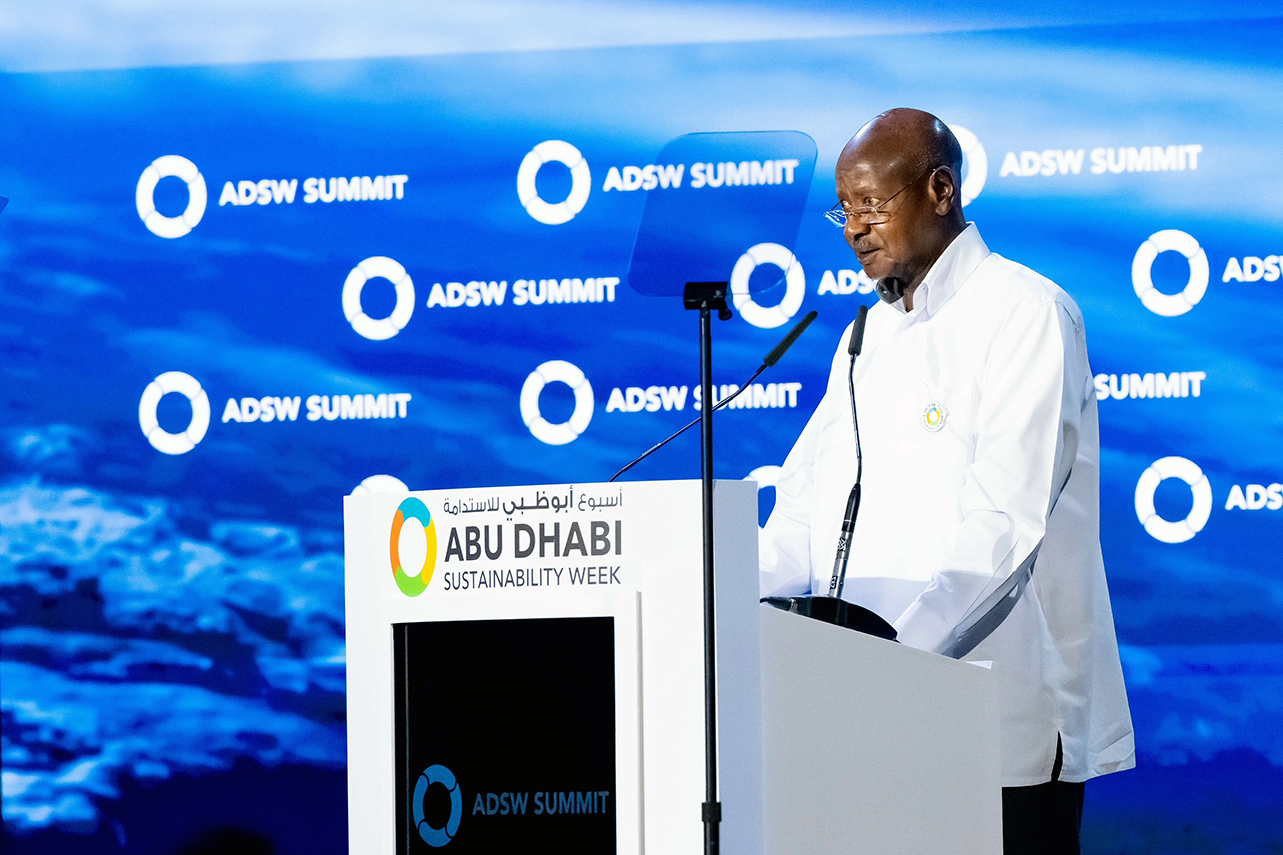

What President Museveni said in Abu Dhabi..

President Museveni has been in Abu Dhabi for the Sustainability Week 2025. This is an abridged version of his speech at the event...

-

Museveni woos Arab Emirates investors to Uganda..

President Yoweri Kaguta Museveni has extended a call to global investors, particularly those in the United Arab Emirates (UAE), to seize lucrative opportunities in Uganda by investing in the country. ..

-

Debt Crisis: Experts want urgent reforms ..

Standing at UG 96.1 trillion ($25.3 billion) as of June 2023, Uganda’s debt burden is approximately 52% of the country’s GDP. This debt comprises UGX 44.6 trillion in domestic debt and UGX 52.8 trillion in foreign debt. In his latest annual report, the Auditor General highlights the growing chal..

-

Central Bank maintains key rate at 9.75%..

The Central Bank Rate (CBR) for February will remain at the same rate of 9.75%, which has been in place since the end of last year, according to the Bank of Uganda. ..

-

URA sees 10% reduction in tax objection cases..

The Uganda Revenue Authority (URA) has reported a 10% decline in tax objections filed during the 2023/2024 financial year - reducing from 45% to 35%. ..

-

New URSB initiative to improve business survival..

The Uganda Registration Services Bureau (URSB) has launched an initiative whose objective is to equip entrepreneurs and corporate entities with essential skills in financial literacy, corporate governance, and business management to enhance business sustainability...

-

GROW: Low funds uptake irks Auditor General..

The Auditor General has raised concerns about the Generating Growth Opportunities and Productivity for Women Enterprises (GROW) project, a key initiative aimed at empowering women entrepreneurs, which he says has recorded a low uptake of funds. ..

-

Coffee, minerals spur Uganda’s exports in December ..

Uganda’s export sector recorded impressive growth in December 2024, with merchandise exports increasing by about 14% according to the January 2025 Performance of the Economy Report released by the Ministry of Finance, Planning and Economic Development...

-

Expert warns as February inflation rate doubles..

Uganda’s monthly headline inflation surged to 0.6% in February 2025, doubling from 0.3% in January, according to the latest data from the Uganda Bureau of Statistics (UBOS). The increase was primarily driven by rising prices of key food items, including tomatoes and fresh leafy vegetables...

-

Business sector rebounds in February - Stanbic report..

Uganda's private sector showed signs of recovery in February, after a temporary slowdown at the start of the year, the Stanbic Bank Purchasing Managers’ Index (PMI) has shown...

-

France offers UGX 340 billion for clean water..

Uganda has secured €85 million (about UGX 340 billion) from the Government of France to enhance water infrastructure and urban development in the Greater Kampala Metropolitan Area (GKMA)...

-

Money laundering, financial crime worries regional States..

In a resounding declaration aimed at securing regional financial stability, the Government of Uganda has pledged support for initiatives battling money laundering and terrorism financing, emphasizing that the stakes are far higher than mere financial compliance. ..

-

Government releases UGX19.79 trillion for Q4..

Government of Uganda has strategically released UGX 19.79 trillion for the fourth and final quarter (April-June 2025) of the Financial Year 2024/25. The capital injection represents about 25.6% of the revised national budget...

-

Central bank maintains key rate at 9.75% ..

The Monetary Policy Committee of the Bank of Uganda has decided to keep the Central Bank interest rate at 9.75% for May. ..

-

May inflation up to 3.8% as food prices surge..

Uganda’s Annual Headline Inflation rose to 3.8% in the 12 months ending May 2025, up slightly from 3.5% in April 2025, according to the latest Consumer Price Index (CPI) report by the Uganda Bureau of Statistics (UBOS). ..

-

Ensure fiscal discipline, civil society tells Government ..

As Finance Minister Matia Kasaija prepares to unveil Uganda’s national budget on June 12, civil society organizations (CSOs) are intensifying calls for greater fiscal discipline, transparency, and improved service delivery warning that without these, public investments will fail to meet the countr..

-

Uganda’s exports revenues soar to $11.8 billion..

Uganda’s export sector has registered remarkable growth, with total exports of goods and services reaching USD 11.8 billion (UGX 45.4 trillion) in the 12 months to March 2025, up from USD 9.56 billion (UGX 36.7 trillion) during the same period in 2024, Finance Minister Matia Kasaija has said. ..

-

Will UGX72.4 trillion budget spur sustainable growth?..

Finance Minister Matia Kasaija has presented the national budget amounting to UGX 72.4 trillion (approximately USD18.8 billion), underscoring the government's strategic focus on transforming the economy, fostering wealth creation, and enhancing the livelihoods of its citizens...

-

UGX4.43 trillion raised from treasury bonds in May..

Uganda’s government raised more than UGX4.43 trillion from the sale of government securities in May 2025, according to the Performance of the Economy Report for May 2025 released by the Ministry of Finance, Planning and Economic Development. ..

-

EAC in crisis over members’ UGX220 bn arrears..

A financial crisis is threatening to cripple the East African Community (EAC) as member states collectively owe a staggering $58 million (UGX 220 billion) in unpaid annual contributions as of March 2025. ..

-

Vulnerable Kanungu pupils get clothing boost..

On Saturday, July 5, 2025, what began as a simple call to action; “Everybody Deserves to Be Smart”, turned into a remarkable display of generosity and shared purpose. ..

-

Annual tax collections surpass target by UGX262 bn..

The Uganda Revenue Authority (URA) has exceeded its revenue collection target for the 2024/25 financial year, registering a surplus of UGX 262.43 billion. ..

-

Uganda's kyeyo remittances hit record UGX5 trn in 2024..

Uganda received a record $1.4 billion (about UGX 5 trillion) in diaspora remittances in 2024, surpassing traditional foreign exchange earners like tourism and coffee. ..

-

Exports boom drives economy to UGX226 Trillion..

A surge in export earnings and foreign direct investment has propelled Uganda’s economy to new heights, with nominal GDP reaching UGX226.34 trillion ($61.3 billion) in the financial year 2024/25. ..

-

15-year Treasury Bond yield shoots to record 17.8%..

Uganda’s domestic debt market remained active and resilient in June 2025, with the government raising UGX 1.86 trillion through three auctions of Treasury Bills and Bonds, according to the June 2025 Performance of the Economy Report released by the Ministry of Finance, Planning, and Economic Devel..

-

Uganda’s headline inflation down to 3.8% in July ..

Uganda’s annual headline inflation has eased to 3.8% in July 2025, down slightly from 3.9% recorded in June, according to the latest figures from the Uganda Bureau of Statistics (UBOS). This decline reflects a combination of declining food prices and stable energy costs, offering some relief to co..

-

Exports, fiscal spending boost business prospects..

Uganda’s economy showed continued resilience and growth momentum in May and June 2025, with key high-frequency indicators pointing to sustained improvements in trade, private sector performance, and overall business sentiment. This progress aligns with preliminary estimates by the Uganda Bureau of..

-

Central Bank holds key rate steady at 9.75% ..

The Bank of Uganda (BoU) has maintained the Central Bank Rate (CBR) at 9.75%, a move that signals caution and confidence as the country navigates global economic uncertainty, geopolitical tensions and excess liquidity pressures during the electoral period. ..

-

Shilling maintaining 14-month appreciation trend - BoU..

The Bank of Uganda (BoU) has confirmed that the Ugandan Shilling has been on a consistent path of appreciation for the last 14 months, a development attributed to strong economic fundamentals rather than direct intervention by the Central bank...

-

Economy on track for 7% growth – Matia Kasaija..

Uganda’s economy is projected to grow by at least 7.0% in the Financial Year 2025/26, with expectations of reaching double-digit growth in the medium term as the country commences commercial oil and gas production, according to the Finance Ministry. ..

-

African postal body, EABC sign partnership MoU..

The East African Business Council (EABC) and Pan African Postal Union (PAPU) have signed a landmark Memorandum of Understanding (MoU) aimed at strengthening cooperation to boost digital trade, cross-border e-commerce, financial inclusion, and efficient logistics services across East Africa...

-

World Bank warns Uganda over climate change impacts..

Without strong action, climate change could cut Uganda's economic growth by up to 3.1% by 2050, pushing more than 613,000 people into poverty and turning 12 million more into internal migrants., a new World Bank report has warned...

-

URA offers 100% tax amnesty on interest, penalties ..

Taxpayers that clear their outstanding principal tax liabilities will be exempted from paying interest and penalties, the Uganda Revenue Authority (URA) has announced. ..

-

High food prices push annual inflation to 4.0%..

Uganda’s annual headline inflation for the year ending September 2025 rose to 4.0%, up from 3.8% in August, which reflects ongoing volatility in the market, largely driven by sharp rises in food prices, and underscores the need for targeted measures to stabilize the agricultural supply chain...

-

UGX 38.61 Tn released for first half of FY 2025/26..

The Government has achieved 53.4% budget execution for the first half of the 2025/26 financial year, releasing a total of UGX 38.61 trillion out of the approved UGX 72.38 trillion national budget. This was confirmed by the Acting Permanent Secretary and Secretary to the Treasury (PSST), Patrick Oc..

Most Recent

UGX 38.61 Tn released for first half of FY 202..

The Government has achieved 53.4% budget execution for the first half of the 2025/26 financial year,..

Uganda incurs UGX13 Tn export losses - report..

Uganda is losing up to $3.5 billion (UGX 13 trillion) every year in perishable agricultural exports ..

UDB gets UGX104 Billion to power SME growth ..

The Uganda Development Bank (UDB) has clinched a USD30 million (UGX 104 billion) financing facility ..

August coffee exports set new 838,000 bags re..

Uganda’s coffee industry soared to new heights in August 2024, earning UGX820 billion from exports..

KK Security rebrands to GardaWorld Security..

KK Security has officially transitioned to GardaWorld Security in Uganda, marking a significant shif..

Digital skills for youth must be an urgent pri..

"I can’t believe this is happening! We have computers now!" exclaimed Aisha Nakalema, a student at..

MTN offers girls’ skilling initiative UGX270..

Smart Girls Foundation, a Kasangati-based girls’ skilling initiative, is set to receive an additio..

- Top Story

Manufacturers task Gov't, banks on high intere..

The Government wants commercial banks to lower the interest rates they charge manufacturers so as to..

- Top Story

MTN scoops fastest internet award..

Ookla, the global leader in internet testing and analysis, has announced MTN Uganda as the Fastest M..

BoU to review StanChart’s exit plan from Uga..

The Bank of Uganda (BoU) is set to assess a proposal from Standard Chartered Bank Uganda regarding t..

Anxiety as donor aid taps shrink further..

During the recent presentation of the Budget Strategy for the Financial Year 2025/2026, officials fr..

Kidepo National Park to get posh airport, hote..

The Government of Uganda has reached an agreement with the Sharjah Chamber of Commerce and Industry,..