Anxiety as donor aid taps shrink further

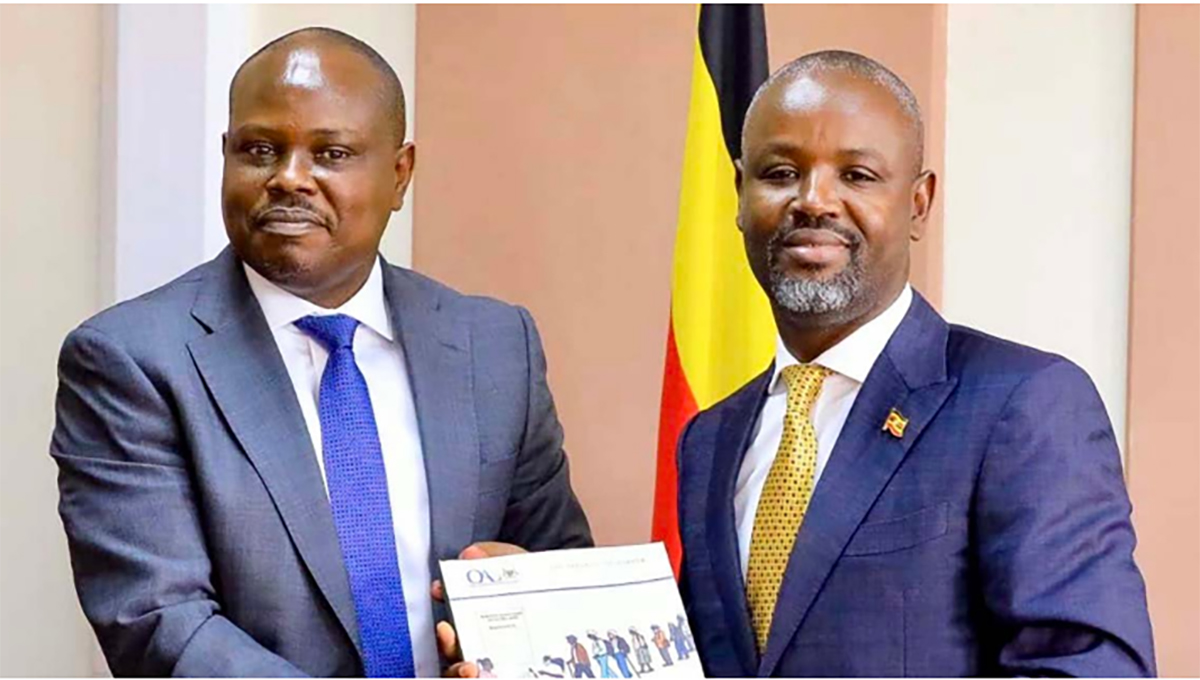

Finance Minister Matia Kasaija must ponder how to drive economy with less donor aid. FILE PHOTO

During the recent presentation of the Budget Strategy for the Financial Year 2025/2026, officials from the Ministry of Finance, Planning and Economic Development warned that dwindling external financing down by approximately 30% from UGX 4.4 trillion (about $1.2 billion) in 2022 to an estimated UGX3.1 trillion (about $840 million) in 2024, could derail the government’s ability to meet essential expenditures on time.

Development analysts say this shift poses significant risks to the nation’s economic stability and growth prospects, raising urgent questions about how to adapt to an increasingly challenging financial landscape.

In 2014 - exactly ten years ago - Uganda received about UGX6.1 trillion (approximately $1.7 billion) in donor support, accounting for roughly 45% of the national budget, a significant amount for critical projects and social services.

- Amos Lugoloobi, the State Minister for Planning, recently attributed the sharp decline to global factors such as the ongoing conflicts in Ukraine and Palestine that have forced major donors to redirect their attention and resources to the war effort. “They are sponsoring the wars in Ukraine, Israel, and Palestine. Their priorities have since shifted,” he stated, while also suggesting that the development partners are expecting Uganda to wean itself off donor aid by now.

Lugoloobi added; “As you grow beyond a middle-income level, donor countries perceive you as capable of sustaining your own growth, which leads them to prioritize assistance for less developed nations.”

This shift in funding dynamics raises alarms about Uganda's reliance on external aid for critical projects, infrastructure development, and social services. In previous years, approximately 40% of Uganda’s annual budget has been supported by donor funding, amounting to an average of UGX7 trillion per year. Without this level of support amid declining tax revenue growth, the country risks stagnating in its growth and failing to tackle pressing issues such as poverty, healthcare, and education.

- Christine Byiringiro, the Programme Officer at Uganda Debt Network, a local NGO, stresses the need for the government to re-evaluate its spending priorities in response to the drying aid taps.

“It’s high time the government reduced spending on luxuries and plan accordingly,” she asserts, echoing public sentiment about the need for austerity measures in the face of declining resources.

Other Civil Society Organizations (CSOs) players have also voiced their concerns regarding the need to slash budget allocations that facilitate corruption and unnecessary expenditures. During a recent post-budget dialogue in Kampala, Dr. Arthur Beinomugisha, Executive Director of Advocates Coalition for Development and Environment (ACODE), described corruption as a severe threat to both the economy and national security. “Corruption undermines public trust and diverts resources from essential services, hindering economic growth and development,” he warned, noting that over UGX740 billion (about $200 million) is lost annually due to corrupt practices.

Matia Kasaija, the Minister of Finance, Planning and Economic Development, reiterated the need for a strategic response to the decline in external financing, emphasizing the importance of the Domestic Revenue Mobilization Strategy (DRMS).

“We shall repurpose the resources in the current budget and improve allocative efficiency to focus on prioritized sectors of the economy,” he noted. This commitment to enhancing domestic revenue collection reflects a critical pivot in Uganda’s fiscal policy, particularly in combating tax evasion and smuggling, which costs the economy an estimated UGX 4 trillion (about $1.1 billion) each year.

- In light of the glaring funding deficit, the government plans to diversify its public financing options through the Public Investment Financing Strategy (PIFS), which will explore concessional and commercial loans, Islamic finance, and climate finance.

- “By expanding our financing toolkit, we aim to mitigate the adverse effects of declining donor support and secure necessary investments,” Kasaija added.

However, the path forward is still fraught with challenges. The success of these strategies hinges on the government’s ability to implement meaningful reforms, enhance transparency, and effectively combat corruption. Without addressing these systemic issues, the reliance on domestic resources may not lead to the desired economic outcomes.

Byiringiro notes that the decline in donor support should raise significant concerns for Uganda’s economic future and the government has to adjust accordingly.

“As global priorities shift and funding diminishes, the government must take decisive action to strengthen domestic revenue mechanisms and combat corruption,” she says. “By focusing on prudent financial management and strategic investment in essential sectors, Uganda can navigate the challenges posed by decreasing donor support and work towards a more sustainable and prosperous future for its citizens.”

.jpeg)