Debt Crisis: Experts want urgent reforms

BoU headquarters in Kampala. Experts warn that the country faces the risk of a sovereign default if current debt trends are not addressed. FILE PHOTO

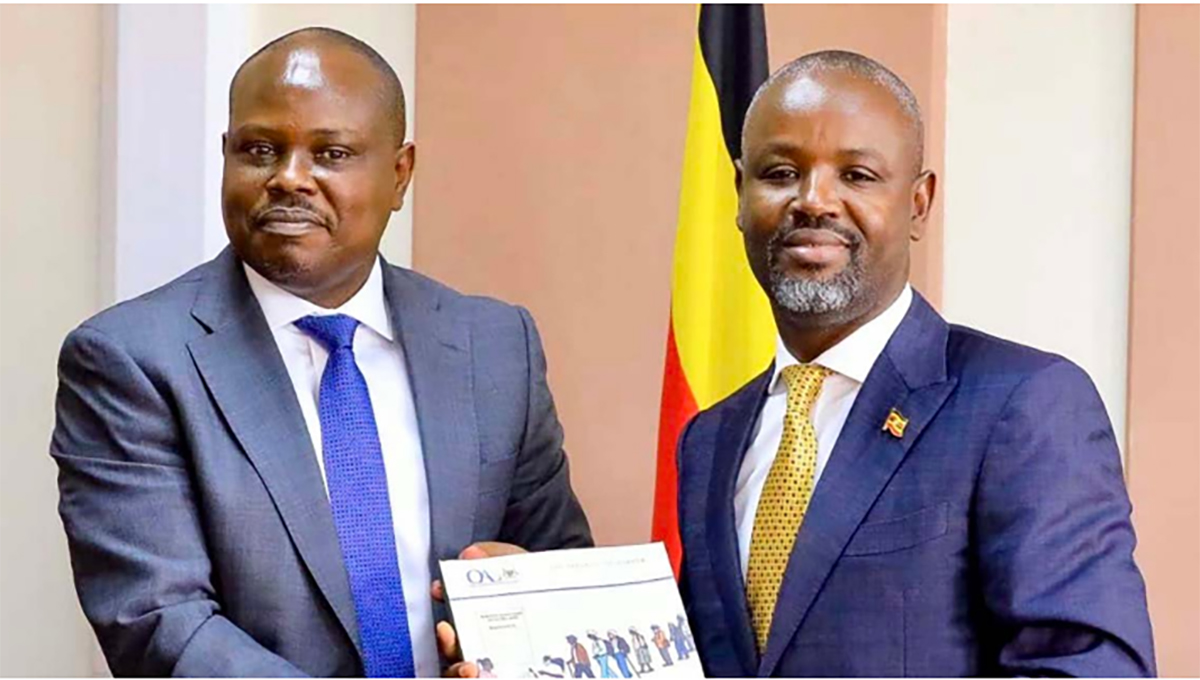

Standing at UG 96.1 trillion ($25.3 billion) as of June 2023, Uganda’s debt burden is approximately 52% of the country’s GDP. This debt comprises UGX 44.6 trillion in domestic debt and UGX 52.8 trillion in foreign debt. In his latest annual report, the Auditor General highlights the growing challenge, and more so given that an additional UGX 7 trillion in loans awaits approval from Parliament.

Analysts argue that this surge in debt, combined with rising servicing costs, stagnating domestic tax revenues, and dwindling export revenues, potentially places Uganda in significant debt distress, raising the specter of a full-blown debt crisis.

The most immediate concern is the mounting cost of servicing Uganda's debt. As of December 2023, interest payments on loans consumed a substantial portion of the budget. According to the Bank of Uganda, 32% of every UGX100 collected in taxes goes towards servicing this debt, and projections suggest that external debt servicing could account for 35% of GDP in 2024/2025.

- Several factors are contributing to Uganda’s rising debt burden. These include the shift in government spending towards infrastructure projects and the impact of the COVID-19 pandemic, which forced the government to borrow extensively to support its economy during the crisis.

In 2018/2019, prior to the pandemic, Uganda's public debt stood at 34.6% of GDP then surged to 50.6% in 2021/22, and projections for 2023/2024 suggest it will surpass 53%, well above the International Monetary Fund’s (IMF) recommended threshold of 50% for low-income countries.

The Uganda Debt Network (UDN), a civil society organization focused on promoting sound public debt management, has raised alarms over the growing debt crisis. "The government’s reliance on expensive non-concessional loans, combined with declining aid and revenue shortfalls, means that Uganda's fiscal position is becoming more precarious by the day," it notes.

- “As the government diverts more and more resources to debt servicing, vital sectors like education, health, and infrastructure are being starved of funds. This is leading to a slowdown in development progress, as the country struggles to balance debt servicing and development needs."

Dr. Fred Muhumuza, an economist at Makerere University and a leading expert on public finance, has been vocal about the need for urgent reforms in Uganda's debt management practices.

Dr. Muhumuza argues that the country's current debt trajectory is unsustainable, noting, "Uganda cannot continue to borrow at this rate without severely compromising future growth and development. The government must focus on reducing borrowing and improving revenue generation to break this cycle."

He has also highlighted the importance of tax administration reforms as a key solution. "The Ugandan tax system is one of the least efficient in the region. There is a need for comprehensive tax reforms that widen the tax base and increase compliance," he explained.

Dr. Muhumuza further emphasized that the government must prioritize investments that provide the highest returns, adding, "Borrowing for infrastructure projects that do not generate sufficient economic returns is a dangerous path. There must be a clear assessment of the economic impact of each borrowing decision."

- In addition to the above-mentioned factors, Uganda has also faced a sharp reduction in aid and development support following the controversial passage of the Anti-Homosexuality Act in 2023. Foreign aid fell from UGX2.781 trillion to just UGX28.94 billion, forcing the government to borrow even more to plug the gap.

- The experts warn that the growing debt burden has several negative implications for Uganda’s economy and social services. The country faces the risk of a sovereign default if current trends are not addressed.

High debt levels stifle economic growth, discourage both public and private investment, and divert critical resources away from essential services. This includes vital sectors such as infrastructure, labor productivity, human capital, and public health, which are crucial for long-term development.

A sluggish tax revenue administration system only exacerbates the problem, exposing the government to greater vulnerability in servicing its debts. If domestic revenues continue to stagnate, Uganda could find itself in an even worse fiscal position, with debt levels exceeding the current 52% of GDP, the experts warn.

That’s why Dr. Muhumuza stresses the importance of managing domestic debt carefully. "While foreign debt is a significant issue, domestic debt has also become a critical concern, especially with high interest rates. The government must balance its domestic borrowing to avoid crowding out private sector investment and ensure long-term financial stability," he says.

.jpeg)