- Home

- Stories

- Financial Services

- Mobile Money

MTN MOMO achieves 100% growth in mobile loans

Mr. Yego says the company targeted to reach 40 million active MOMO users in 2025.

MTN Mobile Money (MoMo) has reported outstanding growth in its digital lending portfolio, marking a 100% increase over the past 12 months.

The success of its digital lending program, which was launched in January, has played a pivotal role in expanding the company’s financial services.

Richard Yego, the Managing Director of MTN MoMo, told journalists at a briefing that their portfolio now includes four loan products—Extra Cash, More Cash, More PESA, and Mopesa—which cater to a diverse range of customers and needs.

- He added that digital lending has been a key driver of financial inclusion, with loans and savings products empowering millions of customers. “The growth we’ve seen in the last year underscores the growing trust in mobile money solutions and their ability to meet the financial needs of our customers,” Yego remarked. The launch of the new loan products has helped the platform expand its reach and significantly improve its disbursement figures.

In the first quarter of this year alone, loan disbursements tripled, a trend that has continued throughout the year. This boost has made MTN MoMo a leader in the digital lending space, particularly in markets where access to traditional banking is limited. Yego explained that the product offering caters to varying customer needs, from small micro-loans to larger sums, making it an attractive option for a wide range of users.

The most popular product in the past nine months has been More PESA, which offers higher loan limits, ranging from UGX200,000 to UGX300,000. “With its higher loan ceilings, More PESA has quickly become the favorite of our customers, and it led the disbursement figures in Q1, with UGX200 billion being distributed monthly,” said Yego. This success reflects the growing demand for more flexible and accessible financial products in the region.

- Meanwhile, Extra Cash, which initially started slowly but has gained substantial traction due to its small loan amounts. This product has attracted a broad user base and is now one of the most widely used.

Yego revealed that the transaction base for Extra Cash has almost doubled this year, with over two million active borrowers utilizing it. Each of the four loan products has contributed at least 20% to the total disbursement figures for the past nine months, highlighting their broad appeal and effective reach.

In addition to the growth in digital lending, MTN MoMo has seen a significant increase in cashless transactions. The number of transactions has grown by 57%, from 16 million to 25 million, while the total transaction value has increased from UGX1.4 trillion to UGX2.1 trillion.

“The disbursement of UGX990 billion over nine months shows our strong performance as we move towards our year-end target of UGX1.2 trillion,” Yego said.

Looking ahead, MTN MoMo has set ambitious targets for 2025, aiming to surpass UGX2 trillion in disbursements. “Our focus for the coming year is to expand our reach and empower even more customers through financial inclusion,” Yego noted.

- As part of this effort, MTN MoMo is exploring key partnerships, including collaborations with the World Food Programme (WFP), the United Nations High Commissioner for Refugees (UNHCR), and the Government of Uganda. These partnerships have already facilitated the disbursement of $7.8 million in financial aid to refugees via mobile money platforms.

- The company has also introduced a revamped overdraft facility, dubbed MoMo Advance, to help customers complete transactions when they fall short of funds. Launched in September, this service has been well-received, further enhancing the platform’s appeal.

MTN MoMo's rapid growth is also reflected in its expanding customer base, which increased from 12 million at the end of 2023 to 13.6 million by mid-2024.

“Our target is to reach 40 million active users by the end of this year,” Yego stated, emphasizing the company’s commitment to increasing purchasing power through greater financial inclusion.

Similar Posts You May Like

-

MTN Uganda awarded as the fastest mobile network in Uganda..

25 th January 2023 - Kampala, Uganda: MTN Uganda has been recognized for the top position as the mobile operator with the fastest internet speed in Uganda, according to user-initiated tests completed on Speedtest® by Ookla®, a global leader in mobile and broadband network intelligence, testing ..

-

BIRDIC Commissions New Generation Tuku Tuku Vehicles to Improve Tooke Distri..

The Banana Industrial Research and Development Center (BIRDIC) whose mission is to use research to develop and market banana-based valued-added products, is embarking on a drive to popularize Tooke flour and related products, by improving their distribution network countrywide. BIRDIC is the succe..

-

Government reaffirms support to scientists..

President Yoweri Kaguta Museveni has warned public officials against taxing innovations, saying there's no logic in taxing innovations when Uganda gives tax holidays to products that are not the result of new ideas...

-

Anxiety As Donor Aid to Uganda Slumps..

Declining donor aid means a higher tax burden on citizens and more foreign debt to bankroll notoriously high public expenditure. Concern is rising as donor cash continues to take a downward slide, which analysts say reflects the escalating levels of donor fatigue and a vote of no confidence over cor..

-

Capital Markets Authority Gets New Boss..

Ms Josephine Ossiya has been appointed Chief Executive Officer of the Capital Markets Authority (CMA)...

-

New DTB, KACITA partnership to boost women enterprises..

Diamond Trust Bank and the Kampala City Traders' Association (KACITA) have entered a partnership aimed at boosting small businesses and entrenching Environmental, Social and Governance (ESG) principles in the country...

-

Stanbic Uganda Holdings Gets New Boss..

Mr. Francis Karuhanga has been named the new Chief Executive Officer of Stanbic Holdings Uganda Ltd, replacing Andrew Mashanda, effective January 1, 2024...

-

Crane Bank Sale: Top BoU, DFCU bosses face prosecution..

The Supreme Court of the United Kingdom has blocked DFCU Bank’s attempt to sidestep the prosecution of its top bosses in a case where they are accused of fraudulently transacting in Crane Bank’s assets in collusion with officials of the Bank of Uganda...

-

140 to lose jobs as BoU revokes EFC's licence..

More than 140 employees of EFC Uganda Ltd, a microfinance deposit-taking institution, are sweating over their next move following a decision by Bank of Uganda to wind up the institution. The institution’s licence was revoked effective January 19, 2024. ..

-

Financial Markets: Uganda Top In EAC..

Uganda has once again asserted its dominance in the East African financial landscape, with the latest Absa Africa Financial Markets Index, highlighting the country's remarkable growth trajectory. ..

-

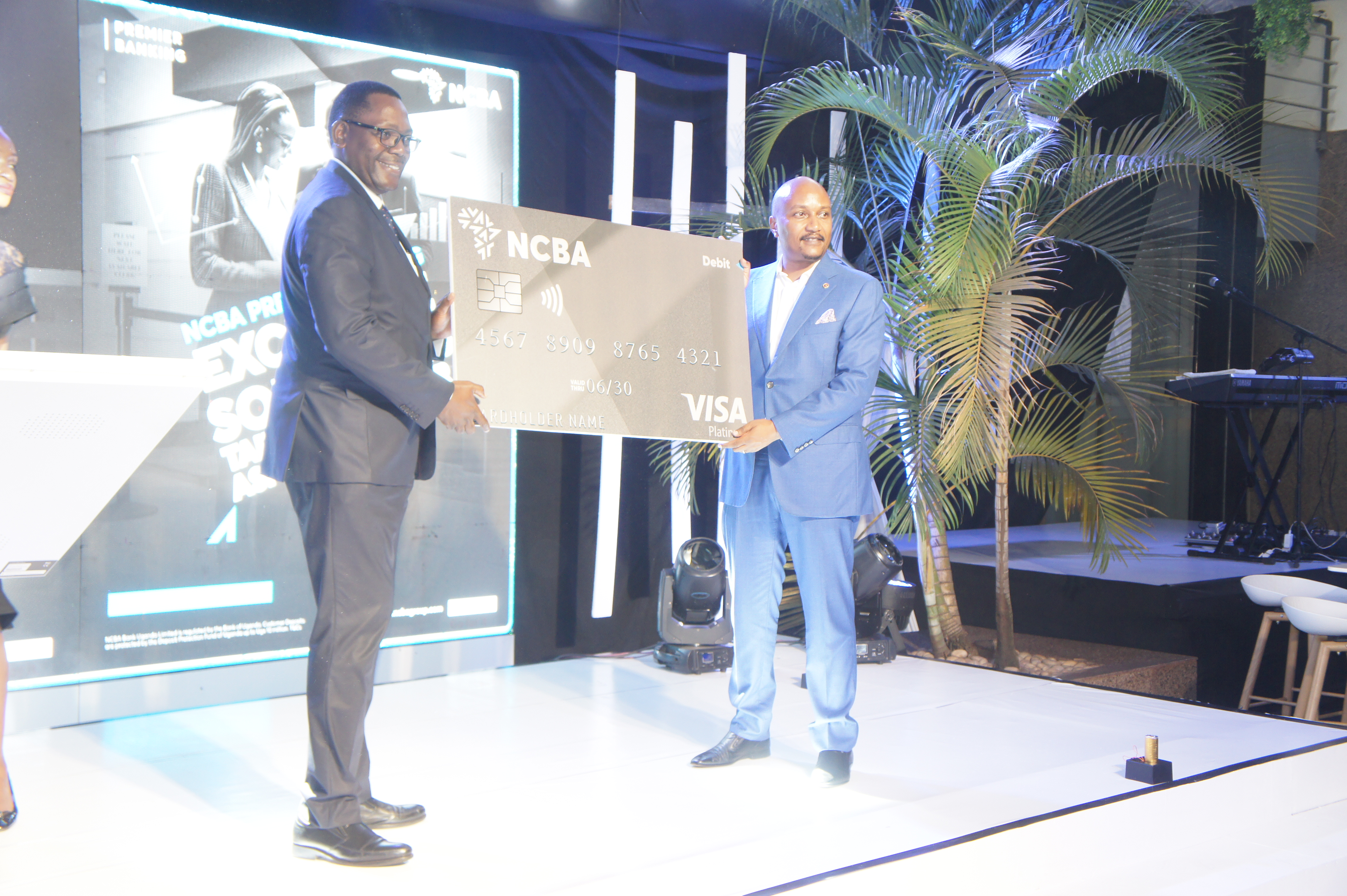

Top NCBA clients to enjoy premier banking service..

NCBA Bank Uganda has made waves in the banking sector with the unveiling of its revamped Premier Banking offering, given the array of exciting benefits and exclusive discounts for its esteemed clientele. ..

-

DTB, TerraPay ease money transfer..

TerraPay, a top European money transfer company, and Diamond Trust Bank Uganda (DTB), have announced a strategic partnership to expand international money transfers and strengthen financial inclusion in Uganda...

-

Semakula appointed SBG Securities boss..

SBG Securities, a subsidiary of Stanbic Uganda Holdings, has named Grace Semakula as its new CEO, effective March 1...

-

Diamond Trust Bank, UAP in new partnership..

Diamond Trust Bank Uganda and UAP Old Mutual Insurance Uganda have entered a partnership to deliver general and life insurance products and services, which effectively makes the bank a one-stop centre for both banking and insurance services, aimed at drive insurance penetration and inclusion...

-

Stanbic declares UGX155 billion in dividends..

Stanbic Uganda Holdings Ltd, the mother company of Stanbic Bank Uganda, have published their annual financial report for the year ended 2023, which has seen the Board of Directors recommending a payment of UGX155 billion in dividends to the company�s shareholders...

-

Sebaana new DTB boss as Thambi exits..

Diamond Trust Bank Uganda (DTBU) has named Godfrey Sebaana as its new CEO and Managing Director, effective April 2, 2024...

-

New report highlights serious gaps in NSSF benefits..

The majority of people who received their benefits from the National Security Fund (NSSF) did not acquire any form of financial literacy before receiving their cash, which severely undermined how they spent the money, a new report has shown. ..

-

Will new online lending guidelines foster responsible borrowing? ..

Last month, the Uganda Microfinance Regulatory Authority (UMRA) introduced digital lending guidelines tailored for microfinance institutions (MFIs) and online lenders in a bold move towards shaping responsible lending and borrowing practices. This move signaled a concerted effort to address the ch..

-

Young golfers shine at NCBA Golf Open ..

Junior golfers from five different countries have demonstrated their talent and passion for the sport at the NCBA Uganda Golf Open 2024, hosted at the Lake Victoria Serena Golf & Spa Resort in Kigo. ..

-

Inflation: Bank of Uganda raises CBR again ..

For the second month in a row, the Bank of Uganda has raised its key rate, the central bank rate (CBR) in a bold move to combat inflation...

-

Will new guidelines mop up online lending mess?..

Moses Nkonge desperately needed cash to put windows and doors in his family house having got fed up of renting. A friend suggested that he gets a loan from an online lending platform. Indeed, he got the money in no time and finished his house...

-

New UDB incubator plan targets 290 entrepreneurs..

The Uganda Development Bank, Uganda's national development finance institution, has announced the launch of an incubator programme designed to prepare hundreds of young entrepreneurs for the funding they need to scale up their businesses...

-

NCBA Bank buoyed by UGX27 bn net profit..

Corporate banker, NCBA Bank Uganda has announced its financial results for the fiscal year 2023, showcasing robust growth and profitability driven by strategic investments in a strong performance culture...

-

I&M Bank partners with Nnaabagereka for Queen's Ball..

I&M Bank Uganda has partnered with the Nnaabagereka Fund to organise the first Queen's Ball, aimed at raising funds to support women, youth, and children with mental issues. ..

-

Bankers protest proposed ATM cash tax..

Commercial banks have objected to the government proposal to impose a 0.5% levy on all cash withdrawals made through ATMs, saying the move would be counterproductive...

-

NCBA Bank partners with NFA to plant 20,000 trees..

Corporate banker, NCBA Bank Uganda, has entered a partnership with the National Forestry Authority (NFA) for an ambitious initiative to re-plant 20,000 trees in the Jubiya Forest Reserve in Masaka District, as part of efforts to replace the dwindling forest cover across the country...

-

Salaried employees warned on saving..

Individuals and businesses should take advantage of the current fragile economic situation to adopt a culture of saving, which is crucial for sustaining the growth of their social well-being...

-

UBA elects new Board as assets soar to UGX50 trillion..

Members of the Uganda Bankers Association (UBA) have voted Julius Kakeeto as their new chairperson, replacing Sarah Arapta. ..

-

BoU chief salutes DTB’s Thambi over exceptional performance..

The Bank of Uganda Acting Governor, Dr Michael Atingi-Ego has hailed Thambi Verghese, the outgoing managing director of Diamond Trust Bank Uganda, for transforming a previously small bank into the financial services giant it is today...

-

New NCBA branch to serve Namanve investors..

NCBA Bank has opened a new branch, strategically located in Namanve Industrial Park near Kampala, a development officials said underscores the bank’s commitment to developing and supporting large businesses in the country..

-

UDB, Centenary Bank scoop top banking accolades..

The Uganda Development Bank (UDB) and Centenary Bank, an indigenous Ugandan bank, have won awards at the prestigious Banker of the Year Awards held in Nairobi, Kenya, on May 29...

-

NCBA Bank injects UGX80m into 2024 Golf Series..

NCBA Bank Uganda in conjunction with the Uganda Golf Club, have launched the 2024 NCBA Golf Series, a premier event aimed at advancing the sport of golf and fostering excellence within Uganda’s golfing community. ..

-

Stanbic’s FlexiPay starts global money transfer..

Ugandans working in the United Arab Emirates, the United Kingdom, the United States, South Africa, Kuwait, and more than a dozen other countries can now send money home, thanks to a new partnership between FlexiPay, Stanbic Bank’s digital payment platform, the International Fund for Agricultural D..

-

Why BoU closed Mercantile Credit Bank..

The banking industry is reeling with shock following the decision by the Bank of Uganda, the regulator of the financial services industry, to close down Mercantile Credit Bank Limited, after over three decades of operation...

-

New MTN’s Zimba initiative to boost small businesses..

MTN MoMo has launched a new initiative designed to empower small and medium-sized enterprises (SMEs) across Uganda. ..

-

Stanbic unveils unit trust investment option..

Stanbic Uganda Holdings Ltd, the mother company of SBG Securities Ltd, has unveiled its unit trust, aimed at enabling individuals and companies to pool their money to create a large fund that generates daily income...

-

NCBA Bank commits millions to central forests restoration..

NCBA Bank Uganda, in collaboration with the National Forestry Authority (NFA), has embarked on the restoration of degraded forests across the country. ..

-

Insurance industry premiums top UGX1.6 trillion ..

The Ugandan insurance sector displayed remarkable resilience and growth in 2023, with Gross Written Premiums (GWP) increasing by 11.3% to reach UGX1.6 trillion year-on-year. This performance, highlighted by the new Insurance Regulatory Authority (IRA) report, highlights the sector's strength and str..

-

Consolidate cross-border collaboration, regional bankers told..

Stakeholders in the banking industry in the East African Region have been urged to find ways of working together more closely in a bid to strengthen their regional economies...

-

Mixed reactions as Bank of Uganda goes for gold..

The Bank of Uganda (BoU) says it is set to start buying gold from the local market, amid concern over the ramifications on the economy given the country’s unregulated or non-transparent market environment...

-

Stanbic Business Incubator gets new boss..

Stanbic Holdings Uganda Ltd has announced the appointment of Catherine Poran as the Chief Executive Officer of Stanbic Business Incubator...

-

DTB plants UGX90m in Kasonke Forest Reserve..

Diamond Trust Bank Uganda has entered a partnership with the National Forestry Authority to restore degraded parts of Kasonke Central Forest Reserve...

-

UDB registers UGX 50 billion profits..

The Uganda Development Bank (UDB) has announced its 2023 annual performance report, highlighting its continued role in fostering economic resilience and sustainable growth in Uganda. ..

-

Stanbic Bank assets, net profits surge ..

Stanbic Uganda Holdings Limited has announced a significant improvement in its financial performance, with total assets reaching UGX9.7 trillion, a 3.8% increase from UGX9.4 trillion the previous year. ..

-

Diamond Trust endorses UN responsible banking principles ..

Diamond Trust Bank (DTB) has become the latest financial institution to sign the UN Principles for Responsible Banking, which aim to align the banking sector with the goals of the UN Sustainable Development Goals (SDGs) and the Paris Agreement on climate change...

-

The Top 10 strongest currencies in 2024..

Globally, the United Nations recognizes 180 currencies as legal tenders. The factors that determine the strength of a currency include the amount of the currency held by other countries as foreign reserves, demand and supply in foreign exchange trading (buying and selling of currencies, in pairs, w..

-

DTB earmarks UGX400m for youth health initiative..

The United Nations Population Fund (UNFPA) and Diamond Trust Bank (DTB) Uganda have signed a partnership worth USD106,458 (about UGX400 million) as a contribution to efforts aimed at reducing school absenteeism and improving menstrual hygiene for young girls in Uganda’s marginalized communities. ..

-

Bank loans grew by 6.8% in 2024, says BoU..

Commercial bank lending activities in Uganda have shown a robust increase, growing by 6.8% in the financial year ending June 2024, according to the Bank of Uganda. ..

-

Watu Uganda celebrates global service accolade ..

Watu Uganda, one of the country’s leading asset-financing companies, has been awarded the prestigious Client Protection Certification award...

-

Fintech industry stimulating local economies..

Uganda is embracing the digital age, and the fintech sector is growing rapidly, transforming how people access financial services. At the forefront of this change is MTN Mobile Money (U) Ltd (MTN MoMo), a leader in mobile financial services that is making it easier for Ugandans to engage with their ..

-

Unit trusts total assets soar to UGX 3.5 trillion..

Uganda's financial assets under management (AUM) in the Collective Investment Scheme (CIS) market have hit an all-time high, reaching UGX 3.5 trillion (approximately US$ 945.4 million) as of September 2024. ..

-

Five men remanded after phone-flashing crackdown..

A crackdown on the growing menace of identity theft, phone theft and flashing fraud has resulted in the arrest and prosecution of five men. ..

-

DTB customers to receive cash at no cost..

Diamond Trust Bank Uganda (DTB) has partnered with Xpress Money, an international money transfer service, to enable customers to receive money in over 170 countries worldwide at no cost. ..

-

DTB enters mobile phone lending segment..

Diamond Trust Bank (DTB) and Credable Group have entered a partnership through which Ugandans will be able to borrow microloans via Airtel Money...

-

Relief as Gov’t sets interest rates for money lenders..

In a bold move aimed at tightening the noose on unscrupulous money lenders, the Government has published Legal Instrument 21 of 2024, which caps interest rates on loans at not more than 2.8% per month (33.6% per annum)...

-

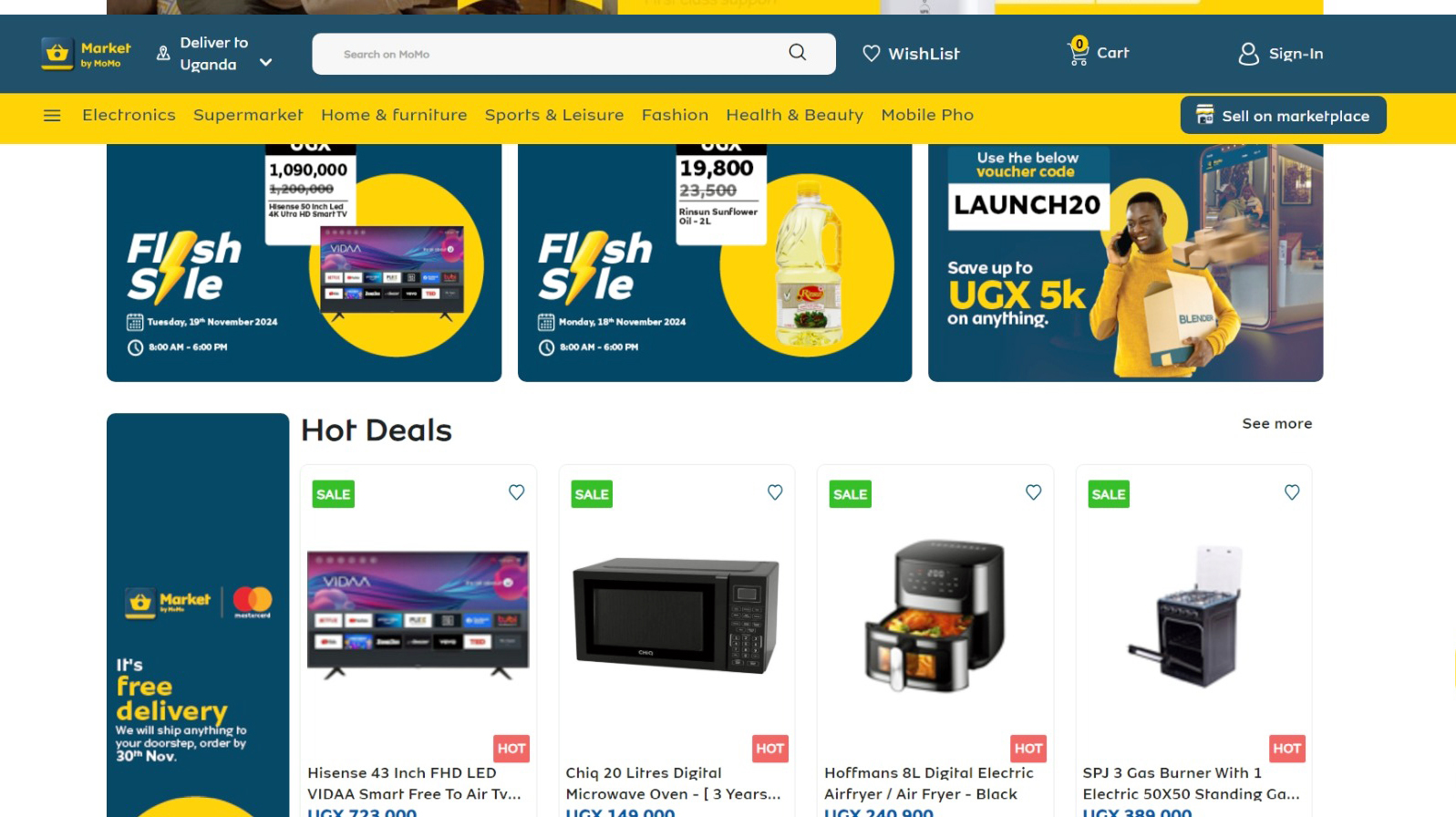

MTN, Mastercard launch e-commerce platform..

In another first, MTN Uganda has become the first subsidiary of the MTN Group to launch an e-commerce platform, aimed at giving Ugandans a seamless online selling and shopping experience...

-

MTN leading way to cashless economy..

In many developed countries, mobile payments, e-wallets and debit/credit cards, are now the most commonly used payment methods. ..

-

Watu opens Uganda’s first boda boda training school..

In a pro-active move aimed addressing the urgent need for road safety and professional motorcycle training, Watu Uganda, a leading asset financing company, has launched motorcycle riding school in Kampala...

-

BoU to review StanChart’s exit plan from Uganda..

The Bank of Uganda (BoU) is set to assess a proposal from Standard Chartered Bank Uganda regarding the sale of its wealth management and retail banking operations in Uganda. ..

-

Credit financing boosting smartphone access..

As Uganda accelerates efforts towards digital integration, device financing is emerging as a critical solution to bridge the digital divide and empower more individuals and businesses to participate in the connected economy...

-

Bank of Uganda denies complicity in $15m theft..

The Bank of Uganda (BoU) has refuted reports that IT systems were hacked, following a multimillion-dollar scam that diverted money to bank accounts in the United Kingdom and Japan. ..

-

Top banker Kalifungwa quits ABSA for Stanbic ..

In a room full of chief executives, he easily stands head and shoulders above them - almost everyone is forced to look up to him. ..

-

Phone asset finance fueling 4G/5G Internet access..

Because of the nature of his business, Moses Wambede always wanted a phone that could access high-speed internet but he didn’t have enough cash. A friend advised him to buy a good phone on loan through asset financing. But on doing the calculations, he found out that the phone costing about UGX1 m..

-

Regional financer boosts Purifaaya water filter maker ..

DOB Equity, an investment fund based in Kenya, has announced that it will provide funding to Spouts International, a company enabling access to clean water through its locally-manufactured ceramic water filters under the brand name Purifaaya. ..

-

DTB, Archbishop team up for Kabaka health initiative..

The Archbishop of Kampala, Paul Ssemwogerere, has praised Kabaka Ronald Mutebi’s initiative to provide healthcare services to his people through the ‘Tubeere Balamu’ (Let's Live) community outreach program. ..

-

Boda loans transforming Uganda’s livelihoods..

When Andrew Mujuni lost his job as a security guard, his world turned upside down. After eight years of dedicated service, he was suddenly retrenched without warning. ..

-

Atingi-Ego appointed Mutebile successor at BoU..

President Yoweri Museveni has appointed Dr. Michael Atingi-Ego as the substantive Governor of the Bank of Uganda (BoU), replacing the late Tumusiime Mutebile...

-

Watu unlocking livelihoods with electric bodas..

Musa Lukwago, a resident of Kyengera on the outskirts of Kampala, started his delivery business in 2016. For a while, business was good—until he began receiving orders that required him to have a reliable means of transport...

-

Women using boda loans to acquire wealth ..

Countrywide, boda bodas have become an essential part of urban transportation, driving daily commutes and fueling economic activity. However, what was once a typically male-dominated industry is now undergoing a remarkable transformation, with women who once hesitated to join the trade, steering the..

-

Stanbic records UGX478 billion profit in 2024..

Stanbic Uganda Holdings Limited (SUHL), the parent company of Stanbic Bank Uganda, has reported a strong financial performance for 2024, recording a profit after tax (PAT) of UGX 478 billion. ..

-

Stock exchange suspends Umeme share trading ..

The Uganda Securities Exchange (USE) has announced the suspension of the Umeme counter on the bourse following the end of the company’s 20-year concession and eventual transfer of electricity distribution to the Government of Uganda...

-

Old Mutual, Airtel launch insurance payment plan..

In a significant move to enhance customer convenience, Old Mutual Life Assurance has partnered with Airtel Uganda to introduce a new digital payment solution through Old Mutual customers can make instant and secure premium payments via Airtel Money. ..

-

Foreign currency turnover tops UGX17.82 tn – BoU..

As of December 31, 2024, Uganda’s forex bureau and money remittance sub-sector had handled foreign currency transactions worth UGX17.82 trillion, reflecting the growing role of this non-bank financial segment in facilitating trade, household welfare, and economic resilience. ..

-

Gov’t, bankers gang up to combat financial cybercrimes..

The Uganda Bankers Association (UBA) has established the Financial Sector Anti-Fraud Consortium, a collaborative initiative designed to proactively address the escalating threat of financial cybercrime...

-

Finance Trust Bank profits surge to UGX10 billion ..

Finance Trust Bank (FTB) has demonstrated a compelling financial performance in 2024, reporting an exceptional 178% surge in after-tax profits, climbing to UGX 10.36 billion from UGX 3.73 billion in the preceding year. ..

-

I&M Bank sees UGX20 billion profit in 2024..

I&M Bank Uganda has demonstrated impressive financial performance for the year ending December 31, 2024, with notable growth across all critical financial indicators, including net profit, assets, revenue, loans and advances, customer deposits, and shareholders' equity. ..

-

NCBA Bank reports UGX46 billion profit in 2024..

NCBA Bank Uganda has announced a 40% increase in its profit before tax earnings, reaching UGX 46 billion in 2024. ..

-

Stanbic AGM approves UGX155 bn dividend pay-out..

The shareholders of Stanbic Uganda Holdings Limited (SUHL) have held their Annual General Meeting (AGM) at which they approved a final dividend...

-

DTB boss optimistic despite tough market conditions ..

The financial sector will continue facing challenging market conditions and banks in particular, will be required to be more agile and resilient in order to take advantage of new opportunities in the fast-evolving financial landscape. ..

-

UDB profits soar as assets hit UGX1.78 trillion ..

The Uganda Development Bank Ltd. (UDB) has announced its financial results for the year 2024, highlighting its growing role in supporting Uganda’s economic development. ..

-

MTN MoMo ventures into life insurance with Sanlam..

MTN Mobile Money Uganda Limited has unveiled Cover by MoMo, a mobile-based insurance platform designed to make insurance simple, accessible, and affordable for Ugandans at the grassroots. ..

-

PostBank's Wendi hits UGX 1 tn in PDM disbursements..

Wendi, a digital wallet developed by PostBank Uganda, has processed more than UGX 1 trillion in cash disbursements to beneficiaries of the Parish Development Model (PDM). ..

-

Banking sector quarterly profits soar by UGX200 bn..

Uganda’s banking sector continues to demonstrate resilience, strong profitability, and sound risk management, Bank of Uganda’s Quarterly Financial Stability Review has shown. ..

-

NCBA gives Makerere marathon UGX1.45 bn boost ..

Makerere University is elevating this year’s edition of the annual MakRun to a fully professional-level event following the announcement of a UGX1.45 billion sponsorship deal from NCBA Bank Uganda. ..

-

DFCU Bank reports 151% profit surge in 2024 ..

DFCU Bank has reported a 151% increase in profit after tax for the financial year 2024. ..

-

Bankers want policy to boost kyeyo remittances..

Banking industry stakeholders are calling for tax incentives and a comprehensive national policy on remittances to boost the inflows and enhance their potential impact on the economy...

-

UK Court rejects Sudhir attempt to block PwC reports..

DFCU Bank has secured a procedural victory in an ongoing case before the English High Court, as part of the legal proceedings initiated by Crane Bank Limited (CBL) and others over its alleged fraudulent sale by the Bank of Uganda...

-

First boda winner announced in MTN MoMo promo..

Nakawa Market in Kampala on Thursday came alive with jubilation as MTN MoMo handed over the first of 24 brand-new motorcycles, as part of its ongoing "Power to Be More" promotion. ..

-

MTN Momo clients to win UGX10m weekly in new promo ..

MTN MoMo Uganda has today announced the launch of its latest promotion, ‘Power to Win,’ a customer reward initiative designed to celebrate and reward MoMo users across the country. ..

-

MTN MoMo named payment partner for Trade Fair..

The Uganda Manufacturers Association (UMA) has today unveiled MTN MoMo as the official payments partner for the upcoming Uganda International Trade Fair (UITF), scheduled to take place from October 2 – 12, 2025 at the UMA Showgrounds, Lugogo in Kampala City...

-

New Absa Bank initiative to boost rural businesses..

Absa Bank Uganda has launched a series of Regional SME Forums aimed at boosting entrepreneurship and business resilience across the country...

-

Uganda, Japanese bank sign financial cooperation deal ..

Uganda has taken a leap in attracting long-term investment, following the signing of a landmark memorandum of understanding (MoU) with the Japan Bank for International Cooperation (JBIC). ..

-

BoU to raise UGX355 bn in Treasury Bills auction..

BoU to raise UGX355 bn in Treasury Bills auction..

-

NSSF bullish as earnings hit UGX3.52 trillion..

The National Social Security Fund (NSSF) has posted earnings worth UGX3.52 trillion for the Financial Year ending June 30, 2025, raising hopes that the interest rate paid to members will see an increase from last year’s 11.5%. ..

-

MTN wins 2025 Employer of the Year accolade ..

MTN Uganda has been named Employer of the Year 2025 by the Federation of Uganda Employers (FUE), winning the Gold Category award for the second consecutive year...

-

ICEA LION unit trust tops UGX 468 billion ..

ICEA LION Asset Management has announced a robust performance for its Unit Trust Funds for the fiscal year ending December 2024, marked by significant growth in assets, revenue, and membership. ..

-

NSSF pays out record UGX 2.79 trillion to members..

Each National Social Security Fund (NSSF) member will receive an average of UGX1 million credited on their pension account, thanks to the 13.5 percent interest rate that the pension Fund has declared for 2024/2025...

-

UDB gets UGX104 Billion to power SME growth ..

The Uganda Development Bank (UDB) has clinched a USD30 million (UGX 104 billion) financing facility from the Islamic Corporation for the Development of the Private Sector (ICD). The partnership marks the first-ever Islamic Line of Finance not only in Uganda but also in the entire East African region..

Most Recent

UGX 38.61 Tn released for first half of FY 202..

The Government has achieved 53.4% budget execution for the first half of the 2025/26 financial year,..

Uganda incurs UGX13 Tn export losses - report..

Uganda is losing up to $3.5 billion (UGX 13 trillion) every year in perishable agricultural exports ..

UDB gets UGX104 Billion to power SME growth ..

The Uganda Development Bank (UDB) has clinched a USD30 million (UGX 104 billion) financing facility ..

August coffee exports set new 838,000 bags re..

Uganda’s coffee industry soared to new heights in August 2024, earning UGX820 billion from exports..

KK Security rebrands to GardaWorld Security..

KK Security has officially transitioned to GardaWorld Security in Uganda, marking a significant shif..

Digital skills for youth must be an urgent pri..

"I can’t believe this is happening! We have computers now!" exclaimed Aisha Nakalema, a student at..

MTN offers girls’ skilling initiative UGX270..

Smart Girls Foundation, a Kasangati-based girls’ skilling initiative, is set to receive an additio..

- Top Story

Manufacturers task Gov't, banks on high intere..

The Government wants commercial banks to lower the interest rates they charge manufacturers so as to..

- Top Story

MTN scoops fastest internet award..

Ookla, the global leader in internet testing and analysis, has announced MTN Uganda as the Fastest M..

BoU to review StanChart’s exit plan from Uga..

The Bank of Uganda (BoU) is set to assess a proposal from Standard Chartered Bank Uganda regarding t..

Anxiety as donor aid taps shrink further..

During the recent presentation of the Budget Strategy for the Financial Year 2025/2026, officials fr..

Kidepo National Park to get posh airport, hote..

The Government of Uganda has reached an agreement with the Sharjah Chamber of Commerce and Industry,..